Private Credit Market Grows with On-Chain Infrastructure Adoption

Private credit, particularly asset-backed finance (ABF), is rapidly expanding in global finance, currently valued at $6.1 trillion with potential growth to over $20 trillion. Despite its size, the industry faces inefficiencies due to reliance on traditional management methods like excel sheets.

- ABF relies on contractual cash flows from underlying assets such as BNPL loans and supply chain receivables.

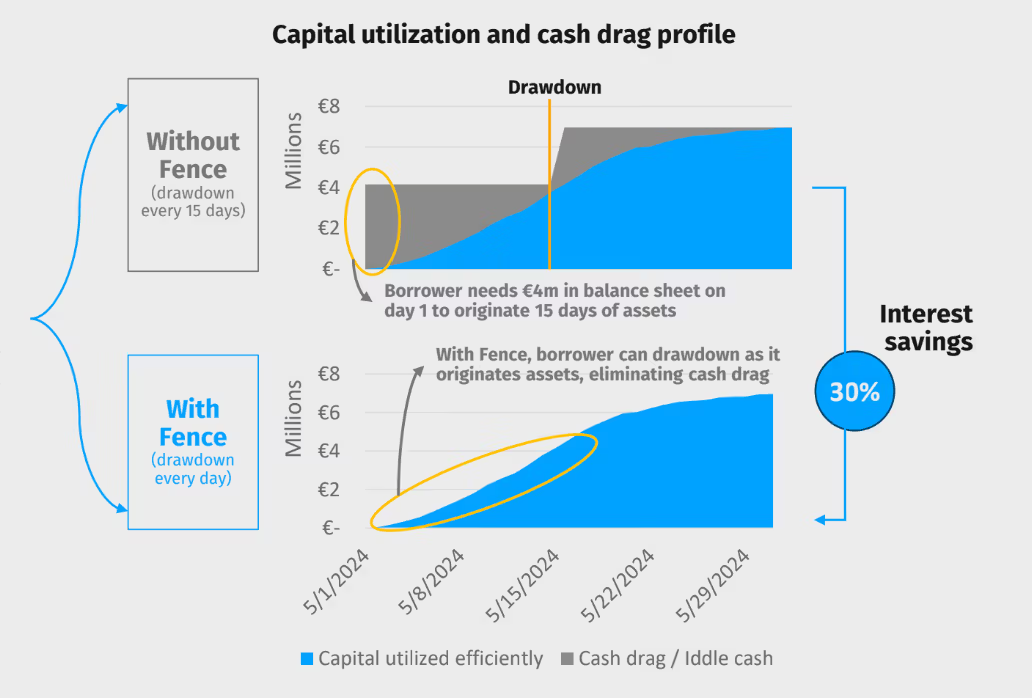

- Current processes result in idle capital and higher financing costs, up to 30% more than necessary.

- Operations are labor-intensive and error-prone, requiring large teams for monitoring and verification.

Web3 technologies are driving a transformative shift in ABF.

- Blockchain infrastructure and programmable money enhance efficiency.

- Programmable credit facilities and stablecoin rails allow for faster origination, cheaper funding, and scalability.

- Tokenizing credit facilities and using smart contracts automate processes like compliance and repayments.

- Platforms like Fence and Intain demonstrate successful implementation of these technologies.

On-chain infrastructure can democratize access to this market, allowing smaller funds and emerging managers to compete without extensive staffing. Traditional incumbents may lose competitive advantage if they do not adopt these new technologies.

As interest in crypto and stablecoins grows, ABF is leveraging these innovations to address existing market frictions and capitalize on new opportunities.