Retail Demand Remains Strong Despite Weaker Cryptocurrency Markets

Bitcoin and major cryptocurrencies declined following the Chicago Mercantile Exchange's denial of futures listings for XRP and SOL. Anticipation builds for a possible interest rate increase from the Bank of Japan on Friday.

- Bitcoin remains above $100,000 with strong retail demand; addresses holding up to 10 BTC acquired over 25,600 BTC last month.

- Long-term holders are reducing spending, indicating commitment to their positions.

- A drop below $100,000 could trigger sell-offs, according to Wintermute's Jake Ostrovskis.

- Whale wallets for XRP have reached an all-time high of 2,083, suggesting increased accumulation.

- Interest in Bitcoin Synths is rising, allowing users to capitalize on Bitcoin price movements without direct ownership.

- Ethereum layer-2 protocols are experiencing record transaction volumes amid capacity concerns.

- U.S. inflation data shows slower growth, potentially influencing the Fed's policy direction positively for risk assets.

Upcoming Events

- Jan. 23: SEC decision on Grayscale Solana Trust proposal.

- Jan. 25: SEC decisions on four spot Solana ETFs.

- Jan. 29: Ice Open Network mainnet launch.

- Feb. 4: MicroStrategy Q4 earnings report.

- Feb. 4: Pepecoin halving event.

- Feb. 5: Boba Network hard fork upgrade.

Market Overview

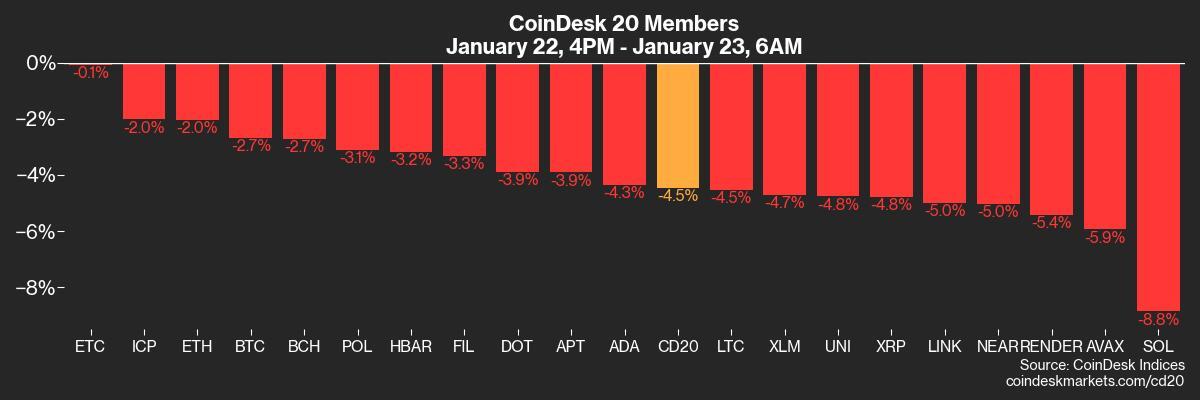

Bitcoin is down 4.1% at $102,020, while Ethereum decreased by 3.85% to $3,206.18. The CoinDesk 20 index fell 3.61% to 3,799.21.

Technical Analysis

BTC's recent price movement suggests a potential double top bearish reversal pattern. A breach below the key horizontal support may lead to further selling pressure.

Token Launches

- Jan. 23: Sky listed on Bitget.

- Jan. 23: Animecoin launching on multiple exchanges including Binance.

Crypto Equities Performance

MicroStrategy closed at $377.31 (-3.03%), Coinbase at $295.85 (+0.56%), Galaxy Digital at C$32.81 (+4.99%).

Derivatives Market

Major cryptocurrencies face net selling pressure in perpetual futures markets. Long positions in BTC puts have been noted at various strike prices.

BTC Dominance stands at 58.59%, with a hashrate average of 781 EH/s.