Robert Kiyosaki Warns of Market Crash, Advises Investing in Bitcoin

Robert Kiyosaki, investor and author of Rich Dad Poor Dad, has warned of a potential global market crash and economic depression. He advises followers on the X platform to invest in real assets such as Silver, Gold, and Bitcoin instead of paper currency.

Kiyosaki believes the global economy is fragile and may soon enter a "depression" phase. Despite Bitcoin's volatility, he remains optimistic about its value. He predicts downturns in economies like Europe, China, and the USA and emphasizes the importance of financial caution.

He stated that a significant barrier to financial success is inadequate money management education, questioning, "What did school teach you about money?" He encourages individuals to retain their jobs and savings, asserting that gold, silver, and Bitcoin are reliable assets that maintain value during economic fluctuations. In his message on the X platform, Kiyosaki wrote:

"Global crash has started. Europe, China. USA going down. Depression ahead? Please be smarter with your money. Hang on to your job and your money. Regardless of which way economy goes, gold, silver, and Bitcoin hold their value. For many people crashes are the best times to get rich."

Signs of Financial Crisis: Is Bitcoin a Safe Haven?

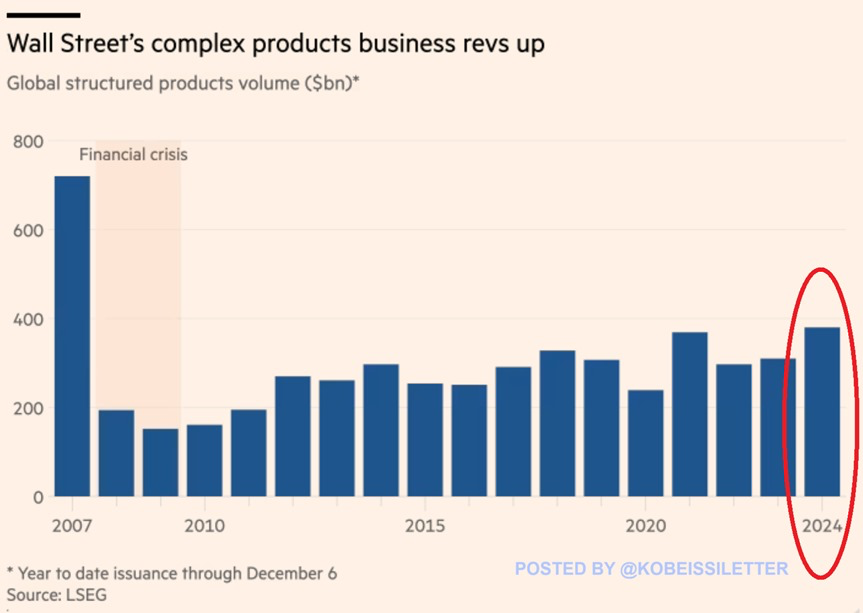

The global volume of complex financial products has reached $380 billion year-to-date, the highest level since 2007, indicating increased market activity. This surge surpasses the 2021 high of approximately $370 billion, driven by rising risk appetite, as reported by The Kobeissi Letter.

-

Courtesy: The Kobeissi Letter

Bitcoin (BTC) has historically correlated strongly with the S&P 500. Following a sharp decline in the index last week due to the Fed's cautious stance on future rate cuts, Bitcoin's price also dropped over 10% from its all-time high of $108K.

Historically, Bitcoin prices have mirrored the global money supply with a lag of about 10 weeks. In October, as the global money supply reached a record high of $108.5 trillion, Bitcoin hit an all-time high of $108,000.

-

Source: Joe Consorti

However, the global money supply has decreased by $4.1 trillion in the past two months, now at $104.4 trillion, the lowest since August. If historical trends continue, this could indicate a potential drop in Bitcoin's price by up to $20,000 in the coming weeks.

The outcome remains uncertain whether Bitcoin will follow global market volatility or if Kiyosaki's assertion of BTC as a safe haven asset will prove accurate.