Robinhood Reports 165% Revenue Growth in Q3 Earnings

Robinhood, an American financial services company, reported a significant recovery in its third-quarter filing for the period ending September 30, 2024. The company disclosed a 165% increase in revenues and year-to-date (YTD) net deposits of $34 million.

This marks a positive development for Robinhood Markets, which faced challenges after restricting trading in GameStop and other meme stocks during a market frenzy in early 2021. The company is reportedly nearing a settlement with affected investors and traders.

Q3 Filing Shows Strong Revenue Performance

Despite past difficulties and regulatory pressures from the SEC, Robinhood posted solid results for Q3. Net deposits reached $34 billion, with revenues rising 36% year-over-year to $367 million, driven primarily by its cryptocurrency unit.

Cryptocurrency revenue surged to $61 million for the quarter, marking a 165% increase. This growth followed the company's acquisition of Bitstamp, which enhanced trading volume.

Impressive Growth Amidst Challenges

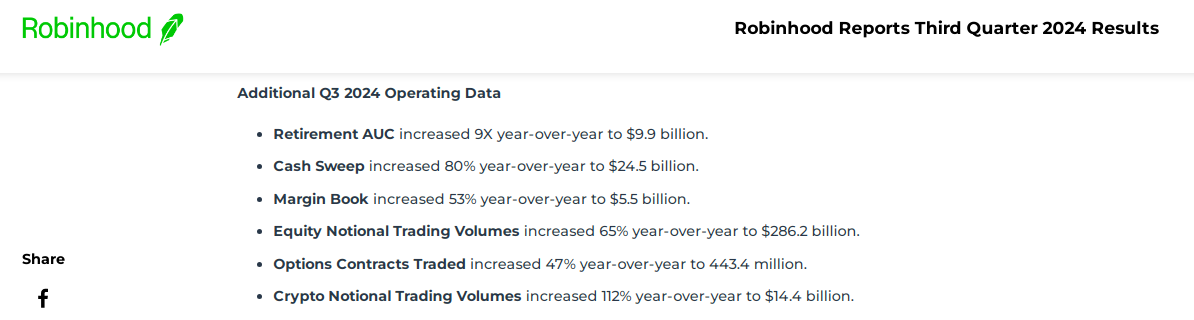

Robinhood's recent growth has garnered attention from market analysts, particularly given its previous issues with FTX and regulatory scrutiny. Last year, Robinhood repurchased shares from Alameda Research for $605 million, leading many to believe it would shy away from cryptocurrency investments. Contrary to expectations, the company has made crypto a key focus through its Robinhood Crypto unit. For Q3, Assets Under Custody (AUC) rose 76% year-over-year to over $152 billion.

Increased holdings were attributed to higher equity values, improved crypto valuations, and steady deposits. Robinhood's portfolio includes a significant amount of Bitcoin, benefiting from its recent price increases as long as the bullish trend continues.

Moving Forward After Regulatory Challenges

Robinhood is navigating away from its past challenges, including the trading scandal related to GameStop in early 2021. In May, the SEC issued a Wells Notice regarding potential violations of securities laws concerning some of Robinhood’s cryptocurrency services, but no formal case has been filed against the company.

Currently, Robinhood continues to operate normally, listing several tokens and allowing transfers for assets like SOL, although access remains limited to EU customers.

Featured image from Omar Marques/SOPA Images/LightRocket via Getty Images, chart from TradingView