Rumble Launches $20 Million Bitcoin Treasury Strategy Amid Growing Corporate Adoption

Bitcoin (BTC) corporate adoption is increasing, exemplified by Rumble's recent announcement of a BTC treasury strategy. This strategy aligns with a trend of corporations worldwide recognizing Bitcoin as a strategic asset.

Rumble Announces Bitcoin Treasury Strategy, Stock Rises

Rumble's Board of Directors approved a strategy to allocate a portion of its excess cash reserves to Bitcoin. The company plans to invest up to $20 million in BTC, describing it as a "valuable tool for strategic planning." CEO Chris Pavlovski noted that Bitcoin’s adoption is accelerating due to a crypto-friendly U.S. presidential administration and rising institutional interest. He emphasized Bitcoin's value as an inflation hedge, unaffected by government money-printing.

Management will assess market conditions, Bitcoin's price, and Rumble's cash flow needs to determine purchase timing and amounts, with the possibility of modifying or pausing the strategy. A poll on X indicated strong support for this decision, with over 93% of 43,790 respondents in favor.

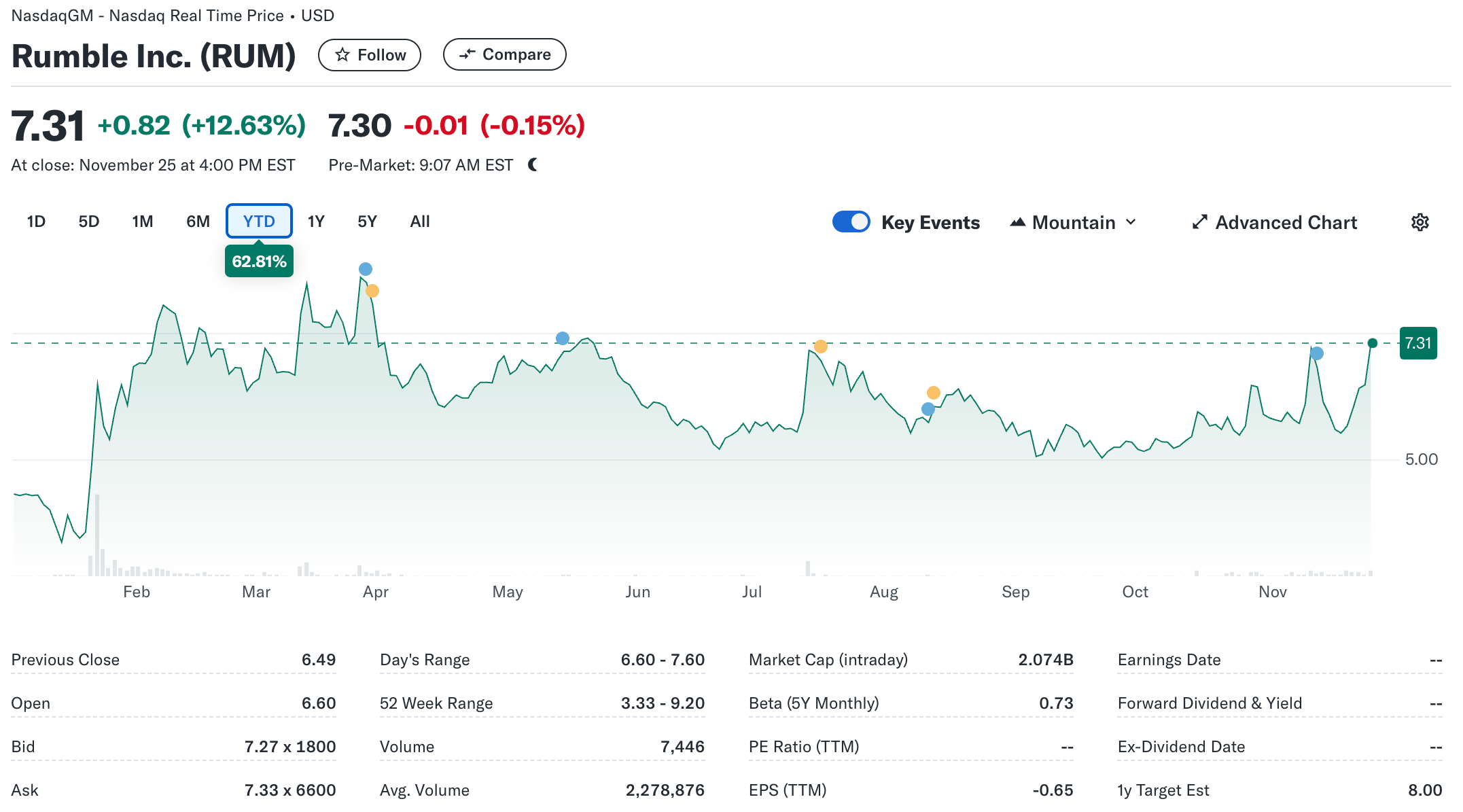

Following the announcement, Rumble's stock price increased by 12.63%, closing at $7.31, reflecting investor confidence.

BTC as a Corporate Asset: A Winning Strategy?

Rumble's strategy parallels MicroStrategy (MSTR), which recently acquired an additional 55,000 BTC, raising its total holdings to $5.4 billion. MicroStrategy's investments have significantly boosted its stock performance, with MSTR shares rising over 670% in the past year, outperforming both BTC and the S&P 500.

Japanese firm Metaplanet has also increased its Bitcoin holdings, surpassing 1,000 BTC through regular purchases. Speculation regarding major companies like Dell and Microsoft entering the Bitcoin market could further drive demand and increase Bitcoin's price. Analysts predict BTC may reach six figures early next year, currently trading at $92,071, down 5.5% in the last 24 hours.