14 0

RWA Sector Valuation Hits $34.4 Billion with $3.9B Inflows in October

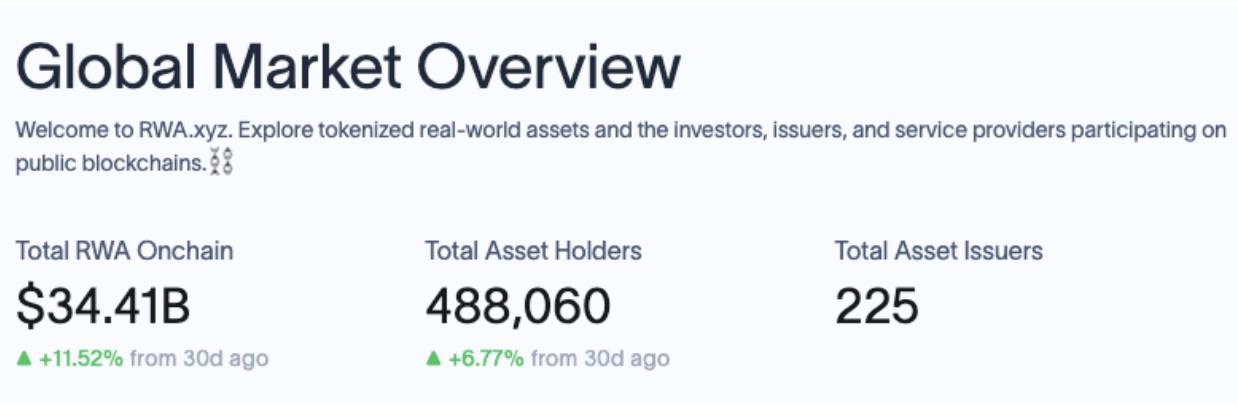

The Real World Asset (RWA) sector valuation reached $34.4 billion on October 18, marking an 11.6% increase with a $3.9 billion rise in total deposits over the last 30 days.

- The U.S. government shutdown and gold's rally above $4,200 have driven RWA inflows despite a weak crypto market.

- The crypto market saw significant liquidations totaling $20.2 billion, impacting prices negatively.

- Tokenized debt, commodities, and private credit products continued attracting inflows as investors seek yield stability.

U.S. Treasuries and Gold-Backed Assets Lead Inflows

- Private credit is the largest RWA category, making up 51.4% of the market at $17.3 billion.

- U.S. public debt and commodities accounted for nearly half of the $3.9 billion in new deposits.

- Tokenized U.S. debt instruments increased from $7.5 billion to $8.3 billion since October's start.

- Commodities-backed RWAs rose from $2.1 billion to $3.2 billion due to gold’s price surge.

- U.S. Treasuries and Commodities saw $1.9 billion in inflows, representing 51% of newly tokenized assets.

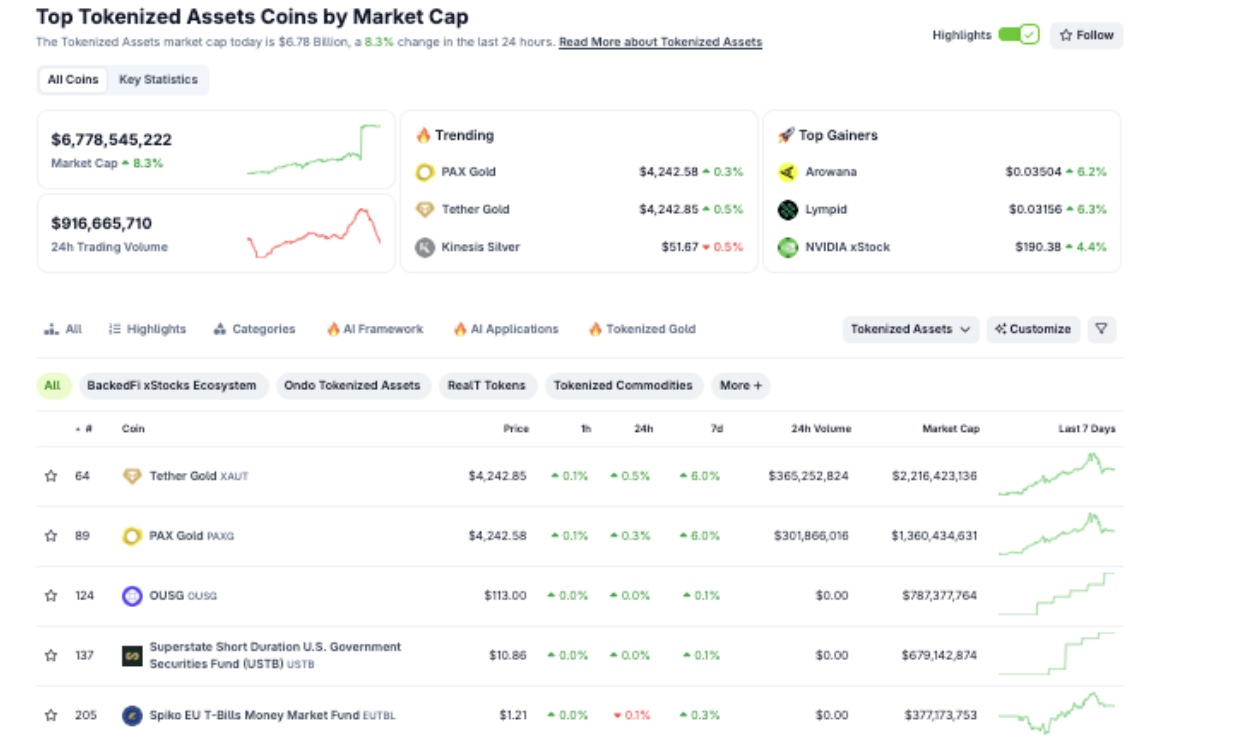

Increased liquidity led to gains for token holders, with the aggregate market cap of tokenized projects reaching $6.78 billion, an 8.3% intraday rise compared to the broader crypto market’s 0.6% increase.