7 0

Saylor Hints at New Bitcoin Purchase Amid Network Stress Signals

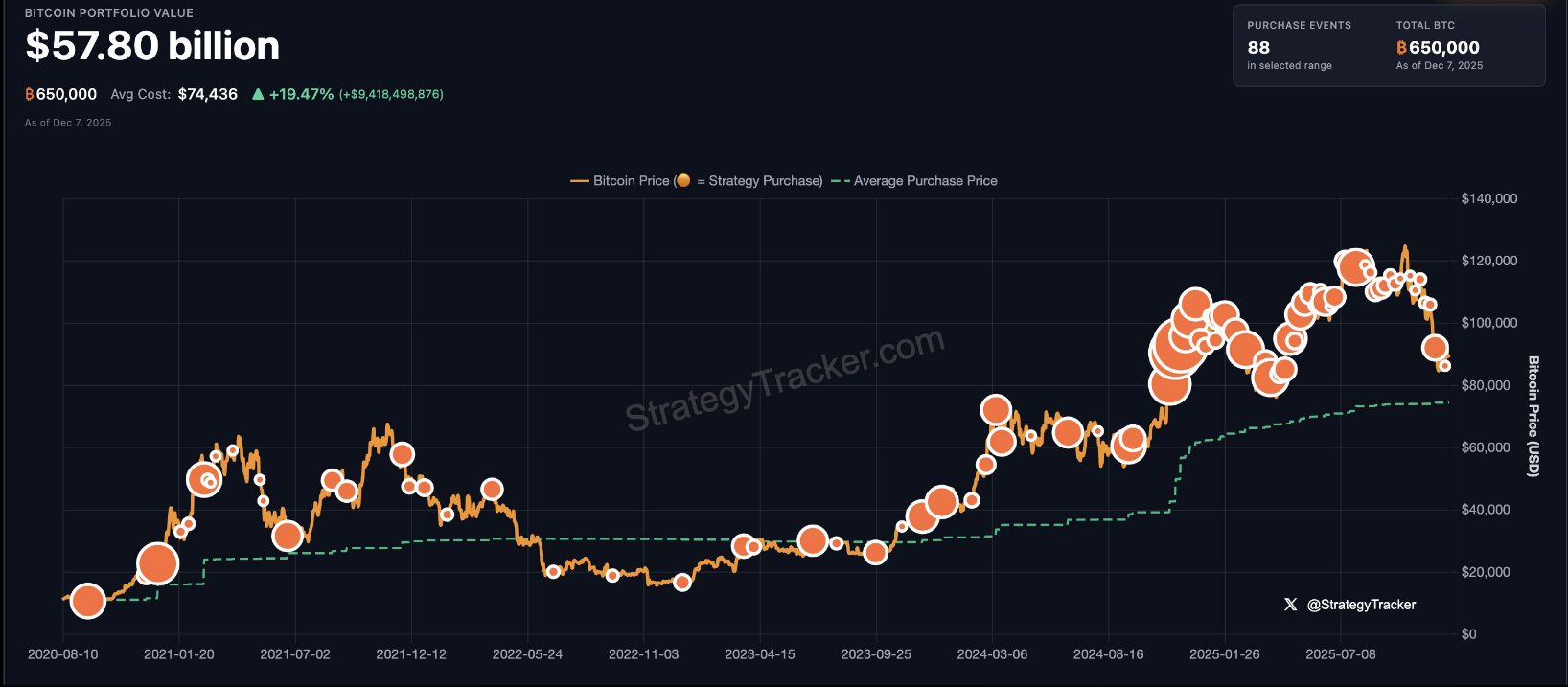

Michael Saylor's recent hint about a new Bitcoin purchase has stirred interest among investors. Despite on-chain stress signals, heavy buying by public firms is attracting attention.

Saylor's Strategy

- Saylor shared a chart showing Strategy holds around 650,000 BTC, valued at $58 billion, with an average purchase price of $74,436 across 88 buy events.

- The latest move was a 130 BTC purchase during market fear, aligning with Strategy's pattern of buying in downturns.

Corporate Accumulation

- Top 100 public firms hold approximately 1,059,453 BTC.

- ABTC added 363 BTC, while Cango Inc. bought 130.6 BTC recently.

- Companies like Bitdeer and Genius Group continue reserve expansions despite price fluctuations.

On-Chain Stress Indicators

- Glassnode charts show the Hash Ribbon is bearish again, indicating miner stress or operational pauses.

- Short-Term Holder NUPL is below zero, suggesting many recent buyers are at a loss.

- This situation often coincides with significant lows when miners and new holders face pressure.

Current Trader Focus

- Traders watch if miner stress and buyer losses will align with big holder purchases.

- Some anticipate corporate buying could mitigate downside and trigger a rebound.

- Market reactions to central bank announcements also impact Bitcoin movements.