SEC Approves Crypto ETF Standards, Potential Uneven Price Impact Expected

The U.S. Securities and Exchange Commission (SEC) has approved generic listing standards for "commodity-based trust shares" on exchanges like Nasdaq, Cboe BZX, and NYSE Arca. This decision is expected to streamline the process for launching new crypto exchange-traded products (ETPs), potentially reshaping investment flows into digital assets.

- The new rules remove the need for individual rule filings for each crypto ETP under Section 19(b) of the Exchange Act.

- An ETP can be listed using these standards if its underlying assets meet specific eligibility criteria, such as trading on a market within the Intermarket Surveillance Group or having futures contracts listed on a CFTC-regulated market for at least six months.

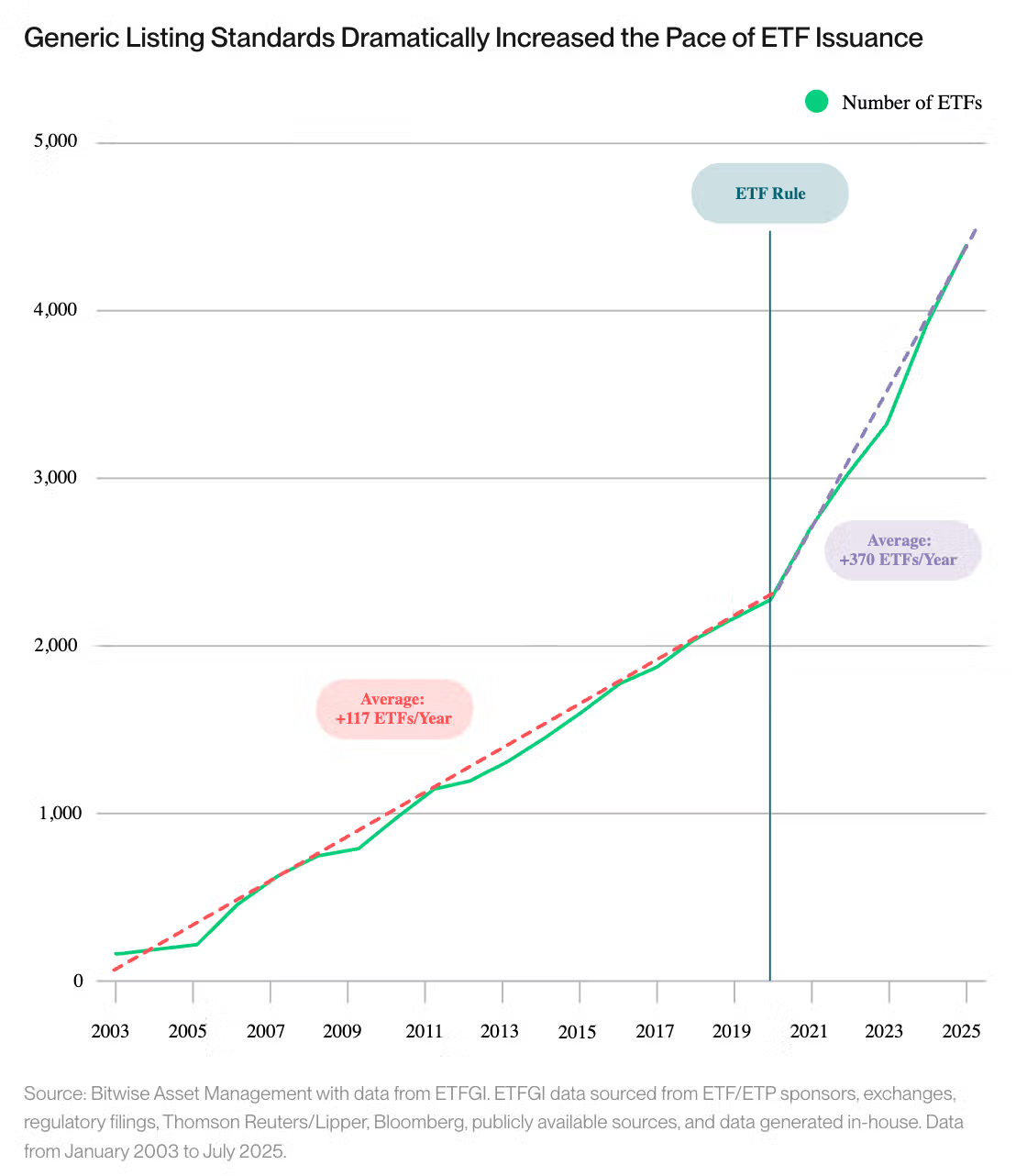

Analysts predict this regulatory change will significantly increase the number of crypto ETF launches, similar to the surge seen in stock and bond ETFs after rule changes in 2019.

Impact on Crypto Prices

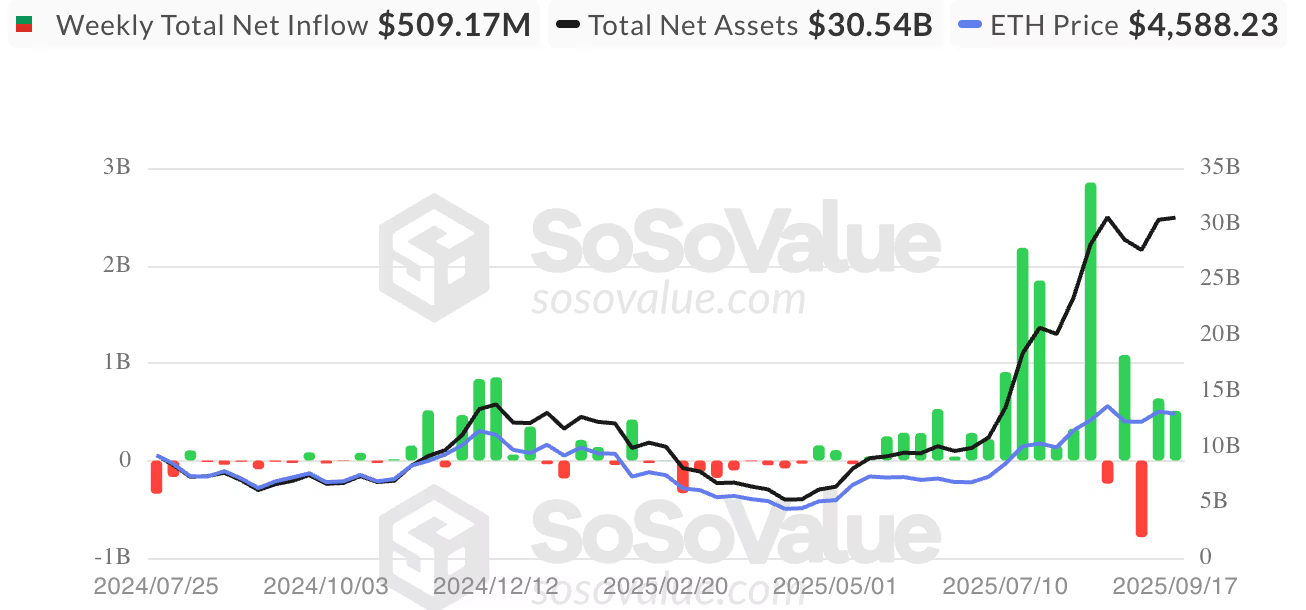

- New crypto ETPs may not automatically lead to large inflows; fundamental interest in the underlying asset is necessary.

- For example, spot Ethereum ETFs saw significant inflows only after stablecoin activity increased.

- Smaller-cap assets without strong use cases might struggle to attract capital without renewed fundamentals.

ETPs make it easier for traditional investors to access cryptocurrencies, demystifying them for mainstream audiences. Large-cap altcoins like Dogecoin, XRP, Solana, Sui, and Aptos are expected to benefit as investors seek opportunities beyond Bitcoin and Ethereum.