Semler Scientific Acquires 211 BTC for $21.5 Million, Totaling 2,084 BTC

Semler Scientific Inc. (NASDAQ: SMLR), a healthcare technology firm, is notable for its Bitcoin investment strategy. Between December 5 and December 15, 2024, Semler acquired 211 BTC at an average price of $101,890 each, amounting to $21.5 million.

Semler Scientific has acquired 211 BTC for ~$21.5 million at ~$101,890 per #bitcoin and has generated BTC Yield of 67.0% QTD and 92.8% since adopting our BTC treasury strategy in May. As of 12/15/24, we held 2,084 $BTC acquired for ~$168.6 million at ~$80,916 per bitcoin. $SMLR

— Eric Semler (@SemlerEric) December 16, 2024

The total Bitcoin holdings increased to 2,084 BTC, costing $168.6 million with an average purchase price of $80,916. Semler financed these acquisitions through proceeds from its at-the-market (ATM) stock offering and operational cash flows.

As of December 13, 2024, Semler raised $100 million through its ATM offering and increased the total offering capacity to $150 million, indicating confidence in leveraging equity markets to support its Bitcoin strategy.

BTC Yield Hits 92.8% Since Treasury Strategy Launch

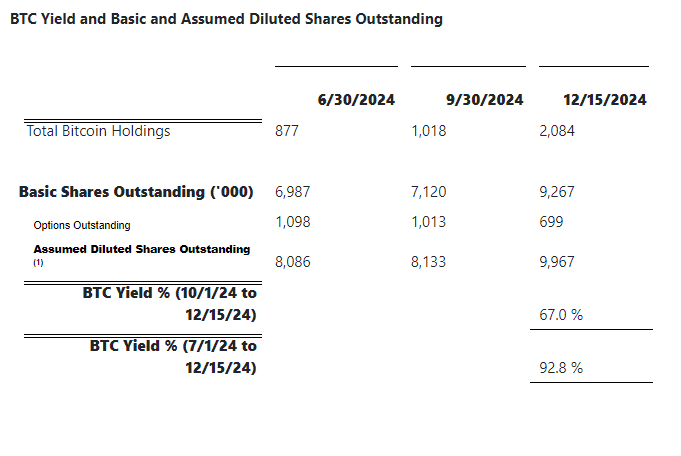

Semler’s BTC Yield, measuring the growth of Bitcoin holdings relative to assumed diluted shares outstanding, reached 92.8% between July 1 and December 15, 2024. For the October-December period, the BTC Yield was 67%, reflecting rapid growth in Bitcoin reserves.

Source: Semlerscientific

BTC Yield is used to evaluate the effectiveness of Semler’s approach in acquiring Bitcoin, supplementing investors’ understanding of its strategy funded by stock sales. However, it does not account for all capital sources for Bitcoin purchases.

Semler Expands Shares Amid Bitcoin Push

By December 2024, Semler significantly increased its share count from 6.99 million in June to 9.27 million by mid-December. Including stock options, the assumed diluted shares totaled 9.97 million.

Semler clarified that its cryptocurrency holdings do not directly influence stock value, which depends on various factors beyond Bitcoin market value. The BTC Yield metric reflects management’s focus on using equity capital to enhance long-term shareholder value.