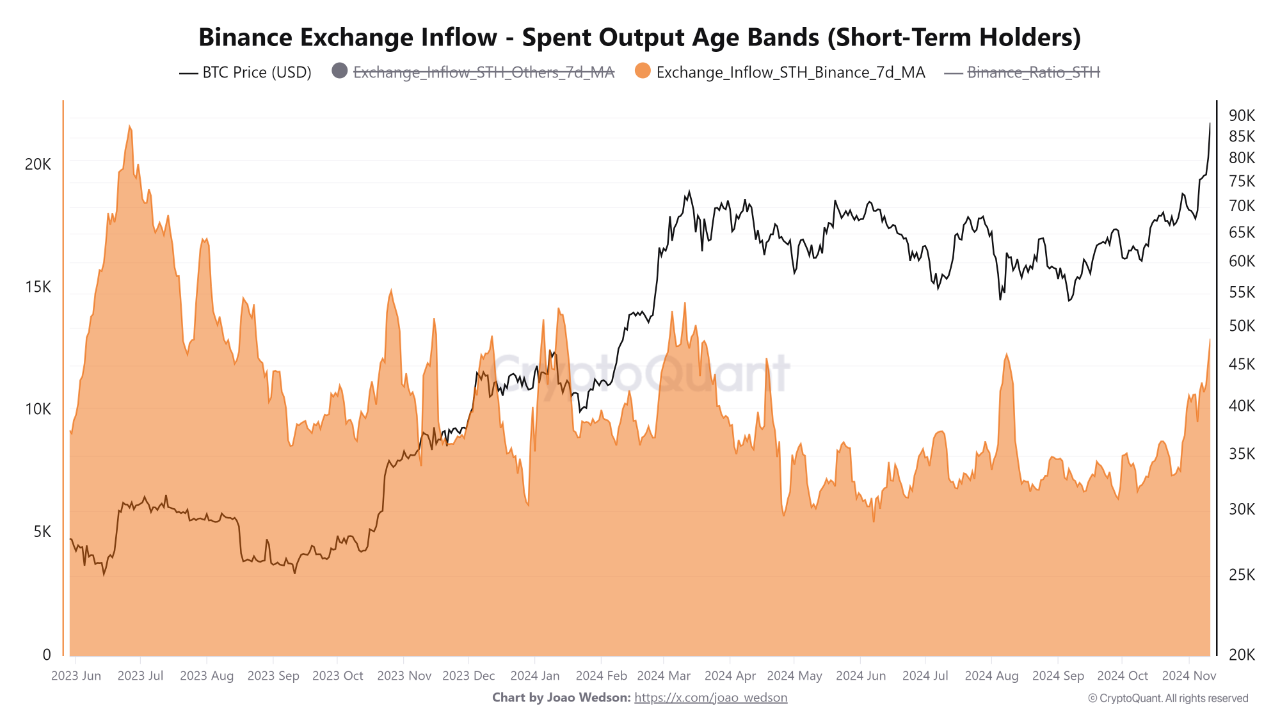

Short-Term Bitcoin Holders Transfer Holdings to Binance Amid Price Surge

Bitcoin has reached an all-time high (ATH) of over $89,000. Following this milestone, a trend emerged where short-term holders are transferring their holdings to major exchanges, particularly Binance.

CryptoQuant analyst Joao Wedson indicates that this behavior suggests investors with shorter time horizons may be preparing to take profits, which could lead to selling pressure in the market.

What To Watch Out For

Wedson emphasizes monitoring Bitcoin deposits to exchanges like Binance, as it can affect liquidity and price stability, potentially impacting the broader market.

Three key areas for market participants to observe include:

- Tracking BTC flows to exchanges, especially Binance, for insights into selling intent among short-term holders.

- Expecting significant price volatility due to concentrated selling or profit-taking on Binance, leading to sharp market movements.

- Anticipating price changes based on these inflows and their influence on overall market behavior.

Bitcoin Market Correction Imminent?

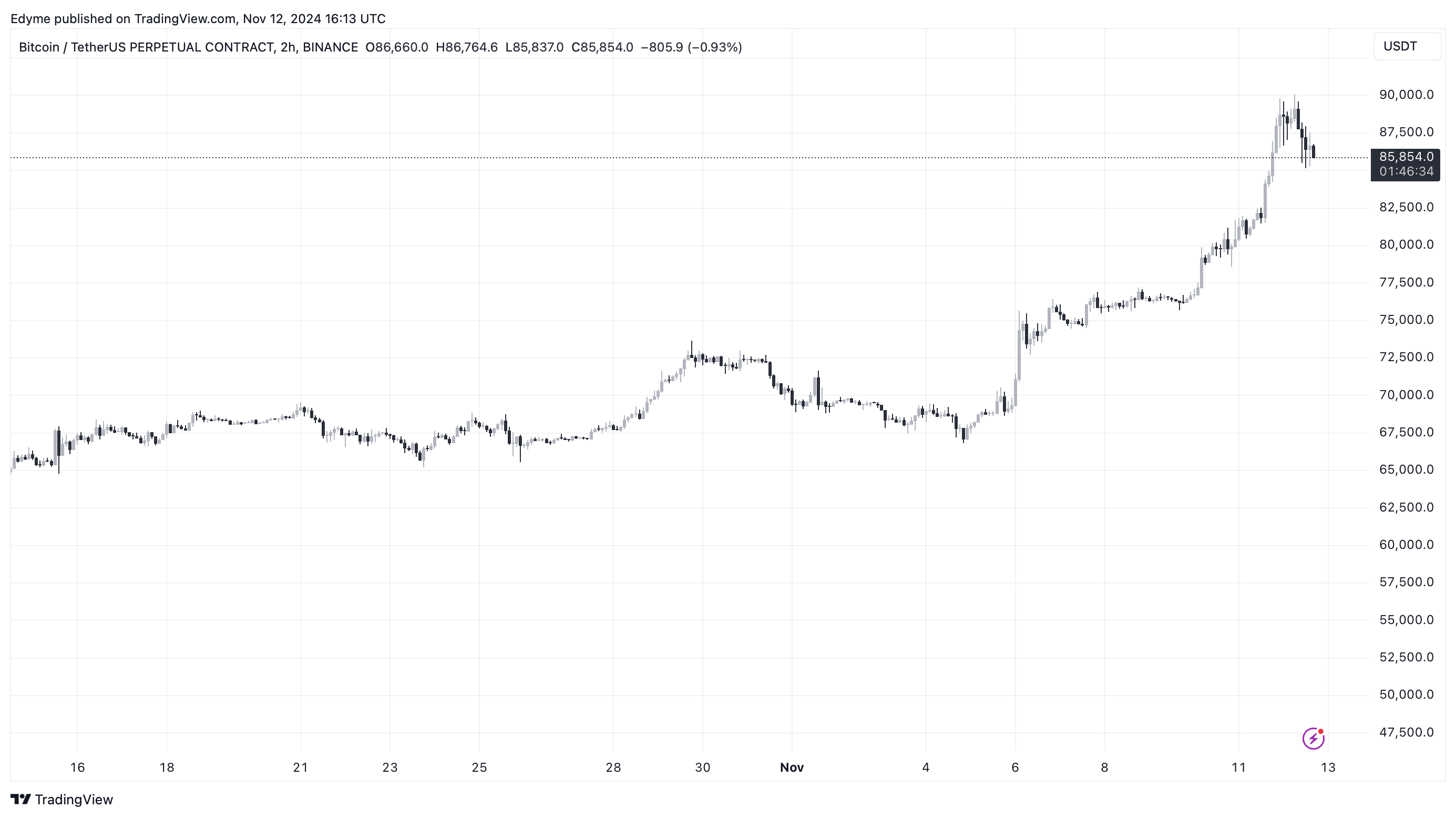

Another CryptoQuant analyst, “caueconomy,” noted that Bitcoin's breakout of its previous ATH has begun a price discovery process. The market has experienced increased open interest levels, with over $16 billion added to futures positions recently, indicating a rise in leveraged positions that can lead to potential corrections.

Despite this, the analyst believes underlying market fundamentals are stronger now, suggesting that any upcoming short-term corrections may be natural adjustments rather than signs of a downturn, providing buying opportunities for investors.

Currently, Bitcoin trades at $86,441, reflecting a 2.3% increase in the past day, but is down 3.6% from its recent ATH of $89,864.

According to analyst Ali, key support levels for Bitcoin to monitor are between $83,250 – $85,800 and $72,880 – $75,520.

Featured image created with DALL-E, Chart from TradingView.