28 January 2025

0 0

Short-Term BTC Holders Sell at Loss as CME Open Interest Plummets

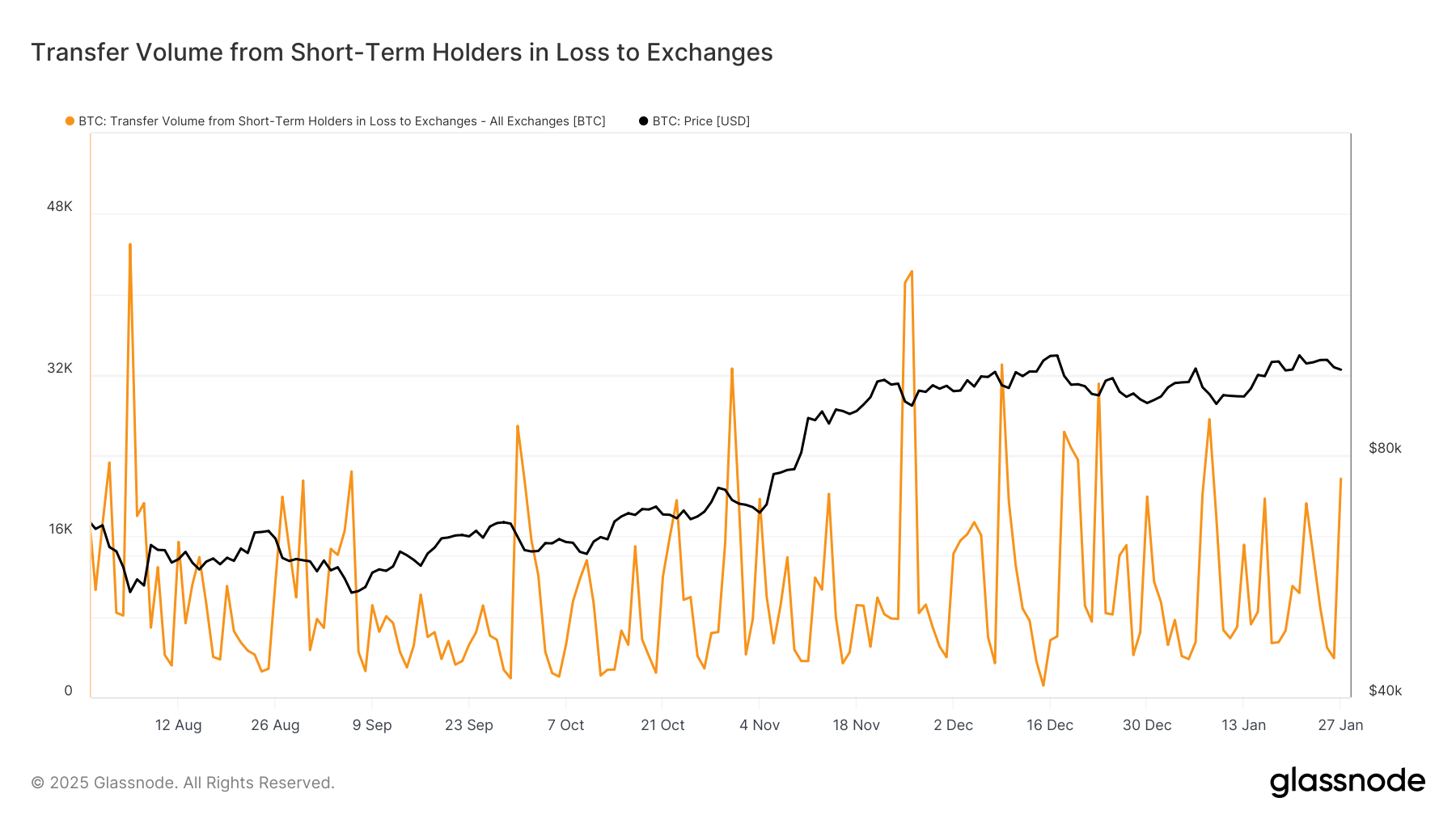

Short-term holders of bitcoin (BTC) sold over 21,000 BTC ($2.2 billion) at a loss as prices fell by up to 4.7%. This marked the second-largest transfer of the month.

Key points:

- Short-term holders are defined as addresses holding coins for less than 155 days.

- The drop in price occurred following concerns about AI competition from China's DeepSeek.

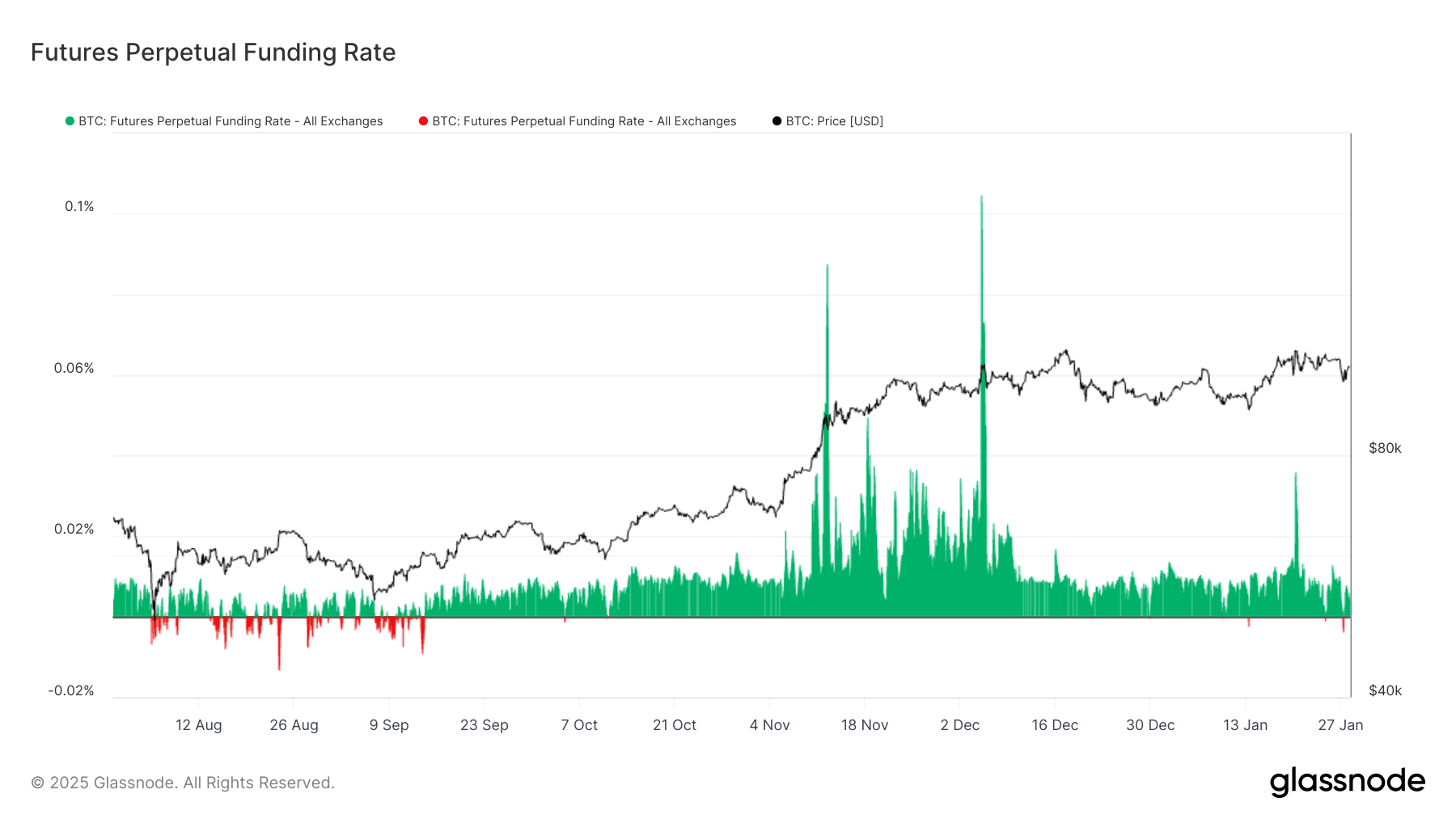

- Perpetual funding rates for BTC turned negative, indicating increased bearish sentiment.

- Open interest on the Chicago Mercantile Exchange fell by $2.4 billion (17,000 BTC), signaling significant de-risking among institutional investors.

- U.S. listed bitcoin ETFs experienced an outflow of $457.6 million.