5 0

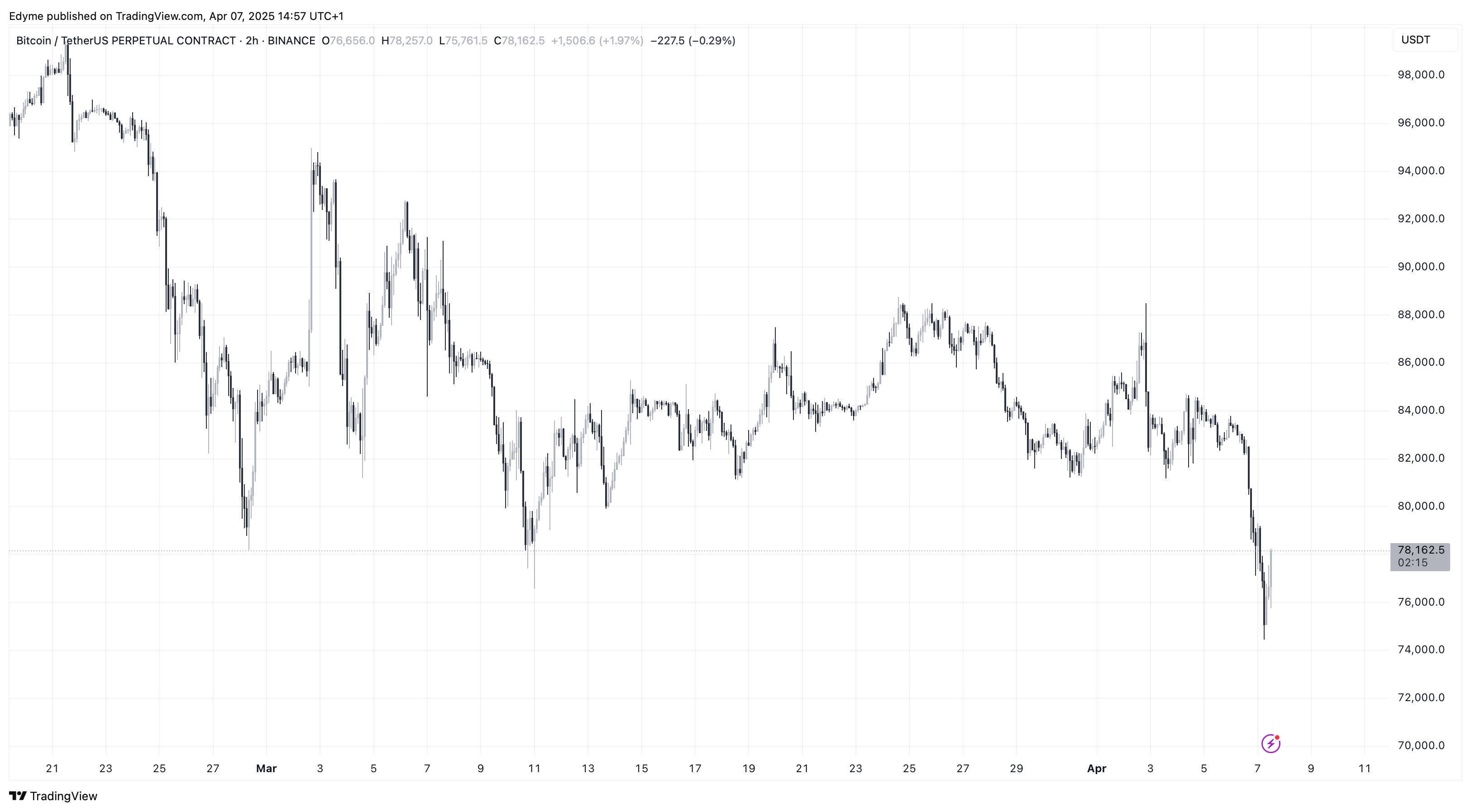

Short-Term Holders Show Signs of Stress as Bitcoin Drops Below $75,000

Bitcoin's price has dropped over 10% in the past two weeks, falling below $75,000 due to global tariff disputes affecting financial markets. This decline coincides with heightened geopolitical and economic uncertainty.

Short-Term Holders Show Early Signs of Stress

- Current market analysis focuses on the Short-Term Holder Spent Output Profit Ratio (STH-SOPR), indicating if recent buyers are selling at a profit or loss.

- A reading below 1.0 suggests holders are realizing losses, often seen as capitulation.

- Despite Bitcoin's price drop, the STH-SOPR hasn't yet reached extreme levels from previous corrections.

- Currently, many short-term holders are not exiting their positions en masse.

- If selling pressure increases, a further market decline could occur.

The key support level to watch is $78,000, which may determine whether Bitcoin stabilizes or faces deeper corrections. Analyst Yonsei Dent highlighted the importance of monitoring this threshold.

Technical Outlook On Bitcoin

- Technically, some analysts view Bitcoin as being in a "green zone," suggesting it is an ideal time for accumulation.

- This region aligns with historical buying opportunities noted in 2015, 2019, and 2020.