6 1

Solana Falls Below $200 Following $45M Long Liquidations

The price of Solana has fallen below $200, hitting a 23-day low at $197.65, as it experiences a five-day decline since September 21.

Key Points

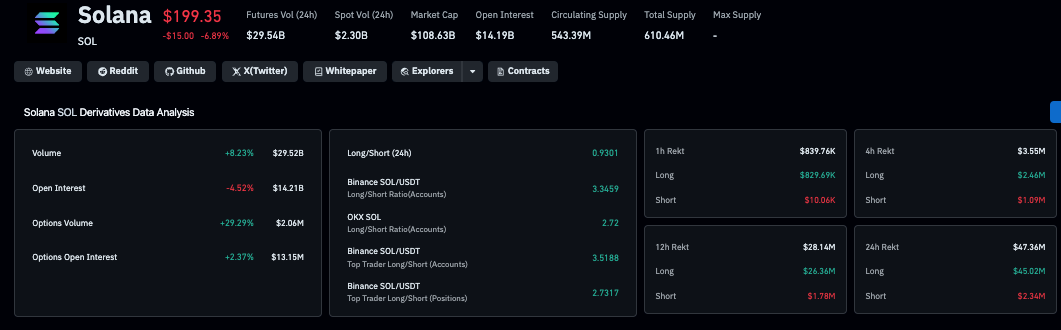

- Panic selling is evident among traders, with Solana's open interest dropping by 4.52% to $14.2 billion and trading volume rising by 8.2% to $29.5 billion.

- Significant liquidations occurred in the derivatives market, with over $45 million in long positions liquidated compared to $2 million in short positions.

- This trend aligns with other major cryptocurrencies like Ethereum, which also fell by 6%, and XRP, declining by 5.7%.

- Bitcoin rebounded due to fresh corporate inflows from Europe.

Price Forecast

- Solana's price is near the $197.65 support level, with potential for further decline to the $189.81 zone if it falls below this key support.

- Technical indicators show bearish momentum, with RSI at 37.47 and BBP at -35.47, indicating weak buyer participation.

- A recovery requires surpassing the resistance at $210 to signal a bullish reversal, potentially targeting $254.72 if sentiment improves.

- Current macroeconomic conditions and recent liquidations suggest that buyers are hesitant to defend positions.

The outlook for Solana remains fragile without increased spot-trading volumes and improved market sentiment.