4 0

Solana’s SOL Rallies 85% as Traders Anticipate $200 Price Target

SOL has increased by 85% since April 7, outperforming BTC, which rose by 40%. The token recently peaked at approximately $176 amid increased risk appetite in crypto and traditional markets.

Key points include:

- Institutional traders are buying large quantities of June 27 expiry SOL $200 call options, indicating expectations for further price increases.

- A significant block trade involved 50,000 contracts worth $263,000 in premium.

- The implied volatility for these options is 84%, lower than typical levels, suggesting a strategic purchase timing.

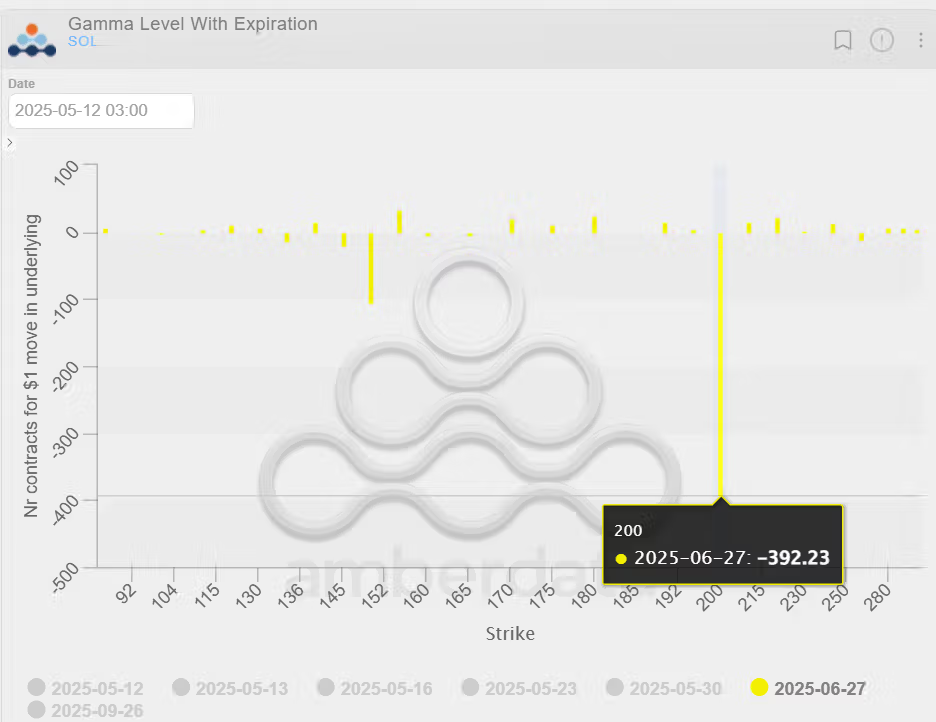

- Market makers face net negative gamma exposure, likely leading to increased volatility as SOL approaches the $200 mark.