7 0

BULLISH 📈 : South Dakota considers investing up to 10% public funds in Bitcoin

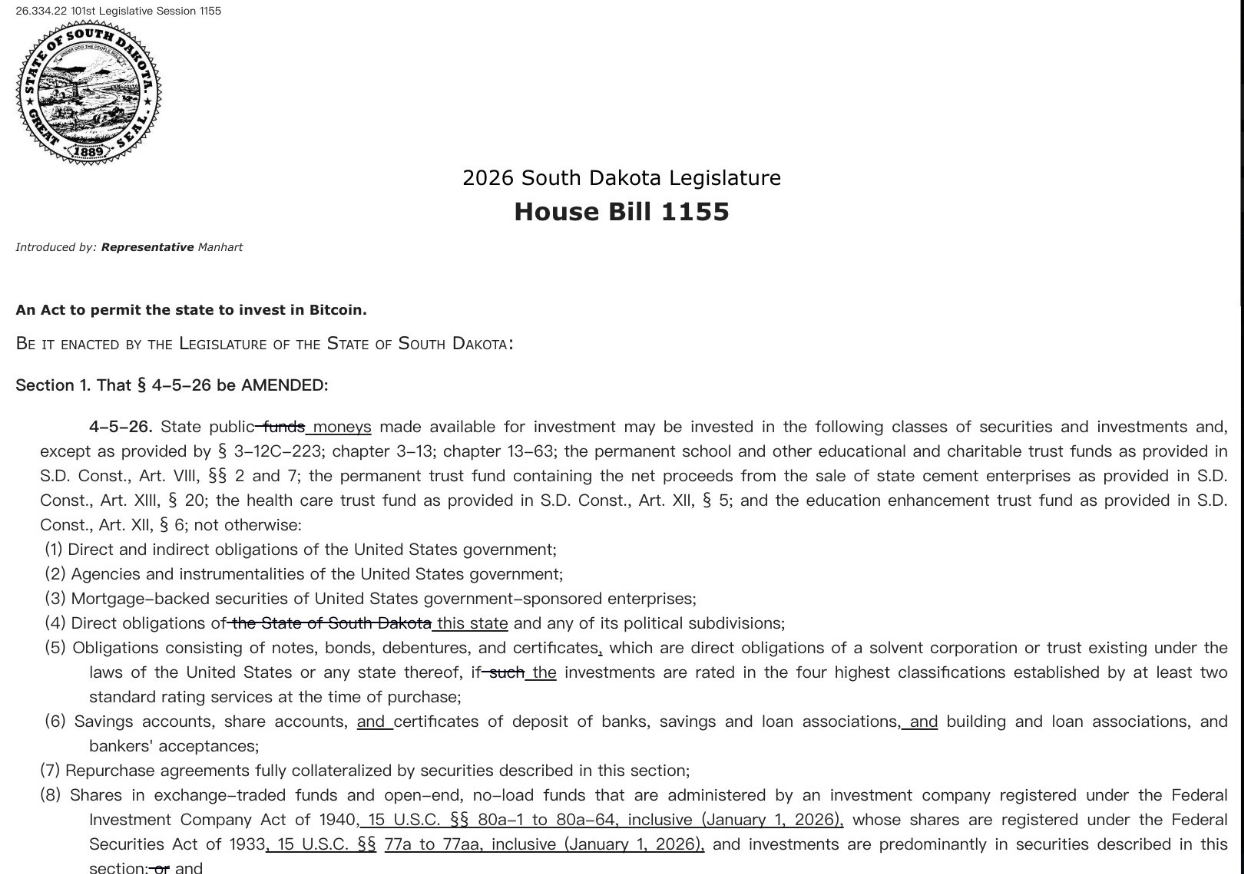

South Dakota is considering a new bill, House Bill 1155, which would allow the state to invest up to 10% of certain public funds into Bitcoin. This initiative, filed by Rep. Logan Manhart, revives a previous effort that did not progress last year.

Key Points of the Bill

- The bill permits the State Investment Council to include Bitcoin in its portfolio, with a strict cap of 10% on exposure.

- Options for investment include direct holdings or regulated products.

- The proposal includes safeguards such as using qualified custodians, encrypted storage, and multi-signature controls to address custody and security concerns.

Considerations and Challenges

- Bitcoin is suggested as a potential hedge and diversification of assets for the state's investment strategy.

- Opponents are concerned about volatility and legal/accounting issues related to state funds.

- The State Investment Council's evaluation of risk and eligible funds will be crucial.

- Fiscal watchdogs and some lawmakers express concern about public perception and the duty of care for funds like pensions.

The bill's success will depend on overcoming practical and political hurdles, as well as addressing concerns about managing volatile assets with public money.