2 0

South Korea Orders Crypto Exchanges to Halt New Lending Products

South Korea’s Financial Services Commission (FSC) has mandated a suspension of new crypto lending products until formal guidelines are established, citing risks to users and market stability.

- Regulators highlighted issues from a recent incident at Bithumb, where over 27,000 customers used lending services, with 13% facing liquidation due to collateral value fluctuations.

- The FSC's directive allows existing loans to continue but prohibits new ones. Non-compliance will result in inspections and supervisory actions.

- Formal lending guidelines are expected in the coming months.

- Galaxy Digital reported that crypto-collateralized loans rose 27% in Q2 to $53.1 billion, the highest since early 2022, amid a global surge in crypto leverage.

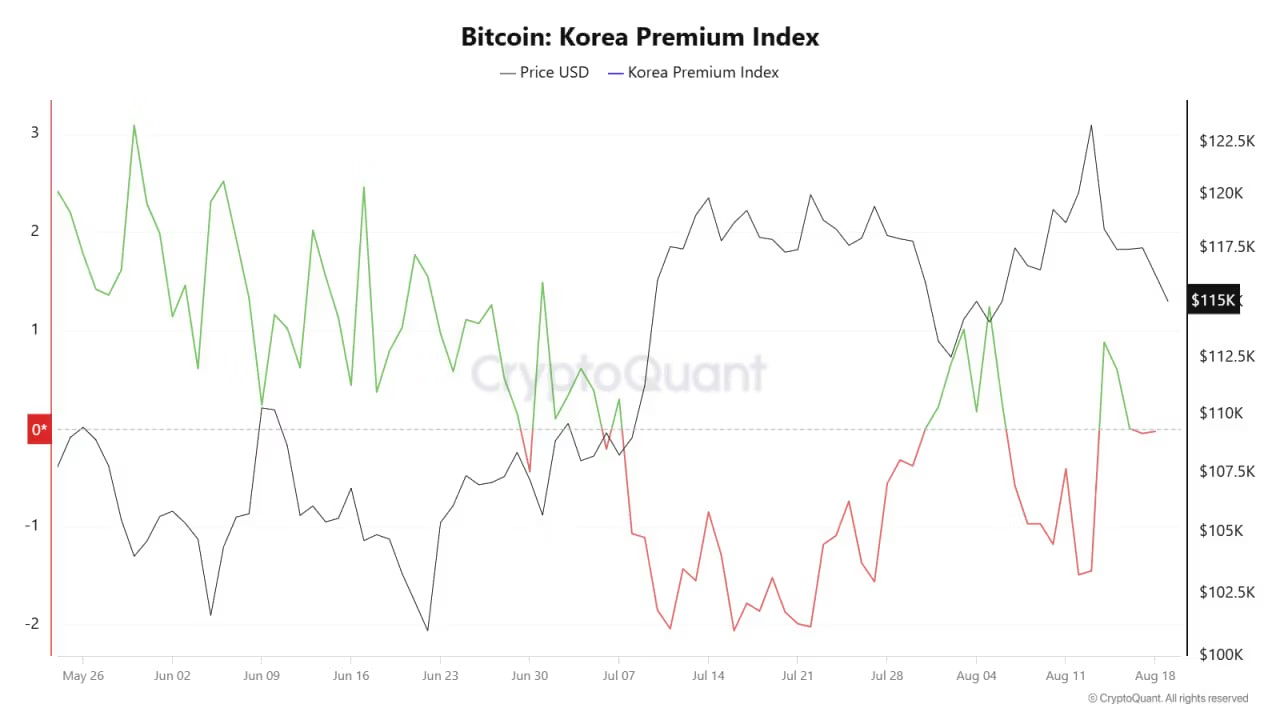

- A recent $1 billion liquidation event was triggered by bitcoin's price drop from $124,000 to $118,000, indicating vulnerability in leveraged positions.

- Analysts noted stress indicators in the system, including DeFi liquidity issues and widening lending rate spreads.

- Some experts argue for better safeguards instead of a complete shutdown, advocating for improved user interfaces and risk disclosures.

- Concerns were raised about transparency gaps in reporting lending activities, particularly with major exchanges like Upbit.