12 2

Spot Bitcoin ETFs Report Over $1.21 Billion Daily Inflow Record

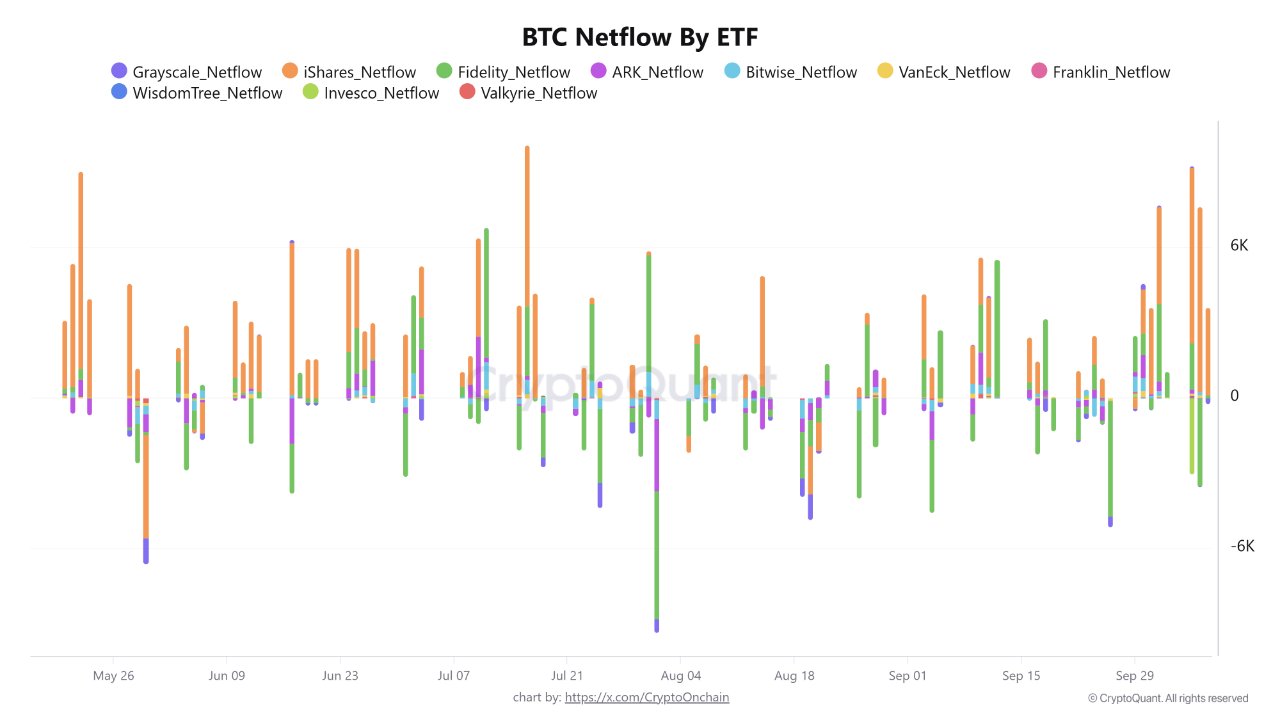

The recent performance of spot Bitcoin ETFs has been robust, with a notable daily inflow record surpassing $1.21 billion over the past two weeks. US-based Bitcoin ETFs have maintained a nine-day streak of positive inflows.

Influence of BlackRock’s IBIT on Bitcoin ETFs

- BlackRock’s iShares Bitcoin Trust (IBIT) has significantly contributed to positive capital flows, acting as a "market's shock absorber" by absorbing sell-side liquidity.

- IBIT achieved a $4.21 billion inflow in October, without any outflow days.

- Fidelity Wise Origin Bitcoin Fund (FBTC) displayed mixed results, indicating portfolio rebalancing among investors.

- Grayscale's GBTC faced challenges with some net outflows.

- Invesco Galaxy Bitcoin ETF (BTCO) experienced a major one-day outflow, causing market pressure, but IBIT's activity stabilized BTC prices.

Any decrease in IBIT's inflows could impact the bullish momentum of Bitcoin. Currently, Bitcoin faces downward pressure due to US-China trade tensions and is valued at approximately $112,143, showing a 7% drop in the last 24 hours.

Steady Institutional Demand for Bitcoin

- Despite recent market downturns initiated by trade war concerns, Bitcoin managed to stay above $120,000 previously.

- Glassnode reported continued capital inflows into Bitcoin ETFs, suggesting underlying structural buying that stabilizes price action despite volatility.