Spot Bitcoin ETFs Attract Over $5 Billion in Investments Amid Price Rally

The Spot Bitcoin ETFs have gained attention due to increased market inflows, attracting over $5 billion in investments in three weeks alongside a 23% Bitcoin price rally. Despite this, macro investment researcher Jim Bianco asserts these ETFs have not significantly contributed to the Bitcoin market's growth.

Spot Bitcoin ETFs Bring In No New Money, Only Recycled Investments

In a series of posts on November 2, Bianco stated that despite substantial inflows, the Spot Bitcoin ETFs do not bring new investments into Bitcoin. He acknowledges the strong performance of institutional funds, some of which are among the top-performing ETFs of 2024 since their launch in January.

Nonetheless, Bitcoin has not surpassed its all-time high of $73,750 set eight months ago, even with over $12 billion in ETF inflows during that time. Bianco argues that such inflows should have driven Bitcoin's price above $100,000, especially with positive indicators like Federal Reserve rate cuts and public endorsements from political figures.

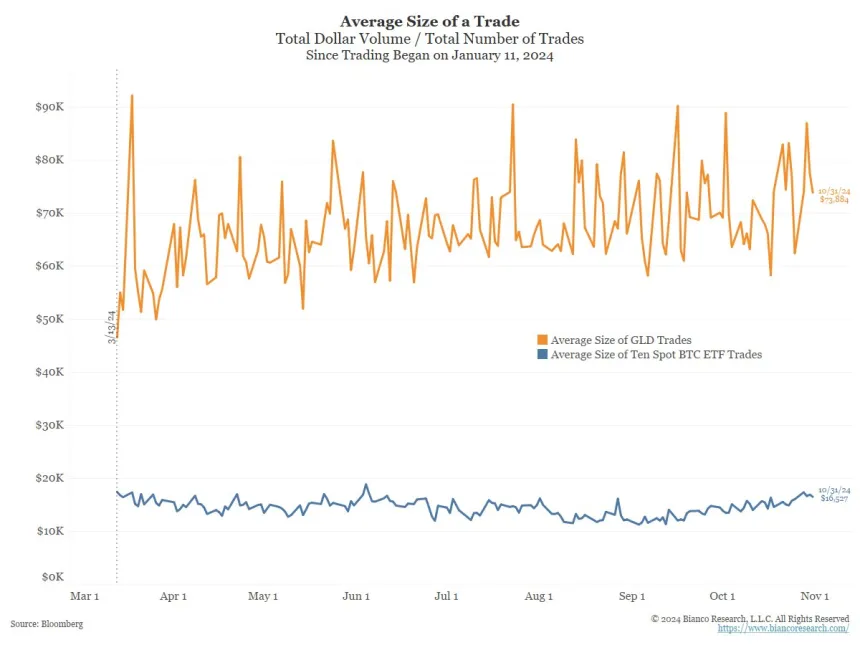

Bianco compares this situation to Gold ETFs, which saw over $6 billion in inflows since March 13, correlating with a 25% increase in gold’s market price attributed to new money entering the market. He suggests that much of the funding for Spot Bitcoin ETFs comes from recycled funds rather than new investments.

This theory is supported by Coinbase CFO Alesia Haas's report indicating a decline in retail bitcoin traders. Additionally, the average Spot BTC ETF trade is $16,000 compared to $72,000 for gold ETFs, suggesting different investor profiles.

Bianco concludes that the Spot Bitcoin ETFs are merely circulating existing investments, raising concerns about increasing influence from traditional financial institutions in the crypto market, contrary to decentralization principles.

Bloomberg Analyst Fires Back At BTC ETF Criticism

Bloomberg ETF analyst Eric Balchunas countered Bianco’s criticism, labeling it as “mental gymnastics.” He praised the performance of Spot Bitcoin ETFs, claiming they have been instrumental in driving Bitcoin's price from $35,000 in January to nearly $70,000 now. Balchunas emphasized the benefits of these ETFs, including low cost, high liquidity, and established brand recognition, advising against betting against them.

As of now, Bitcoin trades at $68,100, reflecting a 2.55% decline in the past 24 hours.

Featured image from Blockzeit, chart from Tradingview