Spot Bitcoin ETFs Attract Nearly $1 Billion in Inflows This Week

The US-based spot Bitcoin ETFs recorded nearly $1 billion in inflows over the past week, while spot Ethereum ETFs faced significant outflows during the same period.

Spot Bitcoin ETFs Attract $3 Billion In 11 Days

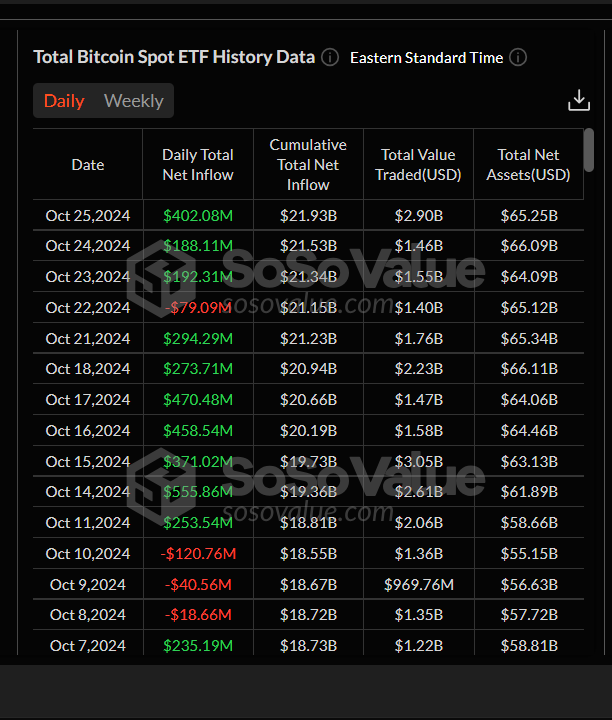

In October’s third week, Spot Bitcoin ETFs attracted $2.18 billion in market inflows, maintaining investor interest with an additional weekly inflow of $997.70 million. According to SoSoValue, inflows occurred on all weekdays except Tuesday, October 22nd, which saw $79.09 million in outflows.

The largest inflow occurred on Friday, October 25, totaling $402.08 million. BlackRock's IBIT contributed $291.96 million, bringing its cumulative net inflows to $23.99 billion. Fidelity’s FBTC followed with $56.95 million, and Ark & 21 Shares’s ARKB attracted $33.37 million. Additional contributions came from Bitwise’s BITB ($2.55 million), Grayscale’s BTC ($5.92 million), and VanEck’s HODL ($11.34 million).

The recent inflows have brought total inflows for Spot Bitcoin ETFs to over $3 billion in the last eleven trading days. Analyst Michaël van de Poppe noted that this trend indicates significant institutional interest in Bitcoin, suggesting a potential price breakout towards $100K.

The cumulative net inflows for Spot Bitcoin ETFs now total $21.93 billion, with total net assets valued at $65.25 billion, representing 4.93% of Bitcoin market shares.

Ethereum ETFs See Negative Returns Again

Spot Ethereum ETFs continue to struggle, experiencing total outflows of $24.45 million over the past week, marking their 11th consecutive week of negative returns since launching on July 26. The total net assets for these Ethereum ETFs stand at $6.82 billion, with cumulative outflows reaching $504.44 million.

As of now, Bitcoin and Ethereum are trading at $67,077 and $2,484, respectively, following minor declines in the past day.