15 1

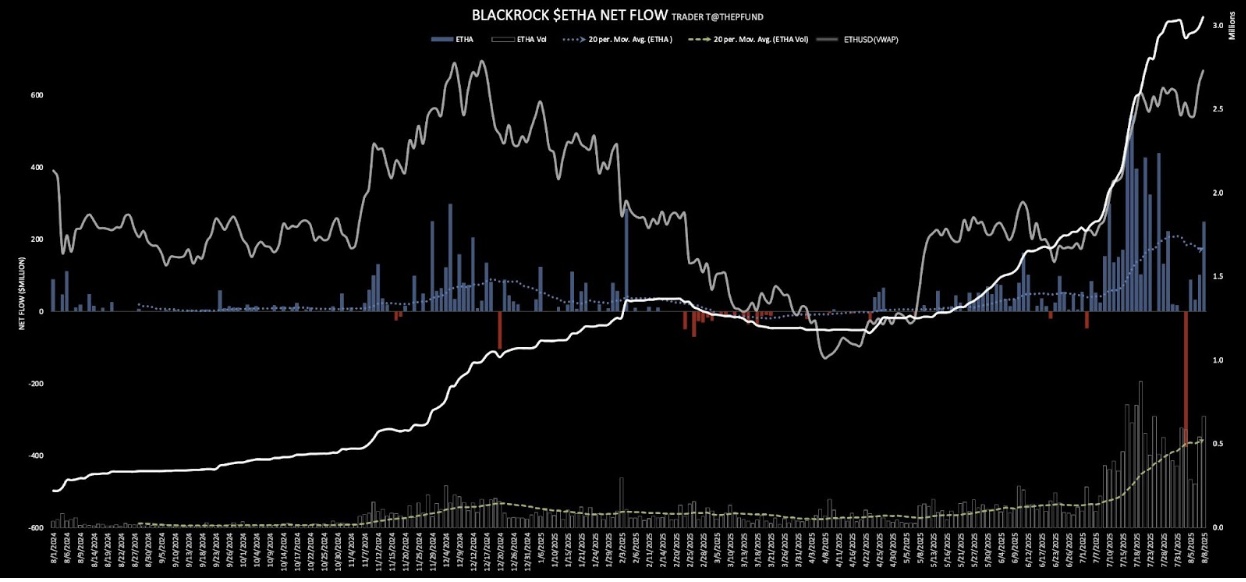

Spot Ethereum ETF Inflows Reach Over $460 Million on August 8

Inflows into spot Ethereum ETFs exceeded $460 million on August 8, coinciding with the ETH price surpassing $4,000 for the first time since December 2024. The BlackRock iShares Ethereum Trust (ETHA) led with inflows of $254.7 million.

BlackRock’s ETHA Leads ETF Inflows

- ETHA saw net inflows of $254 million, purchasing 62,936 ETH.

- Total trading volume for ETHA reached $1.7 billion during the session.

- Net inflows into ETHA since inception approached $10 billion.

- ETHA share price rose 5% to close at $30.79, gaining 47% over the past month.

- Fidelity’s FETH contributed $132 million in inflows.

ETH Price Rally Triggers Short Liquidations

- Approximately $105 million worth of Ether short positions were liquidated, accounting for 53% of total liquidations ($199.61 million) in the crypto market.

- The ETH price rally past $4,000 has led to significant short liquidations.

- Analyst Michael van de Poppe noted the potential for a breakout but advised caution at current highs.

- Market analysts suggest the ETH rally could lead to an altcoin season, with other coins like XRP, ADA, SOL, and DOGE gaining 5-10%.

Blackrock Ethereum ETF inflows | Source: Trader T