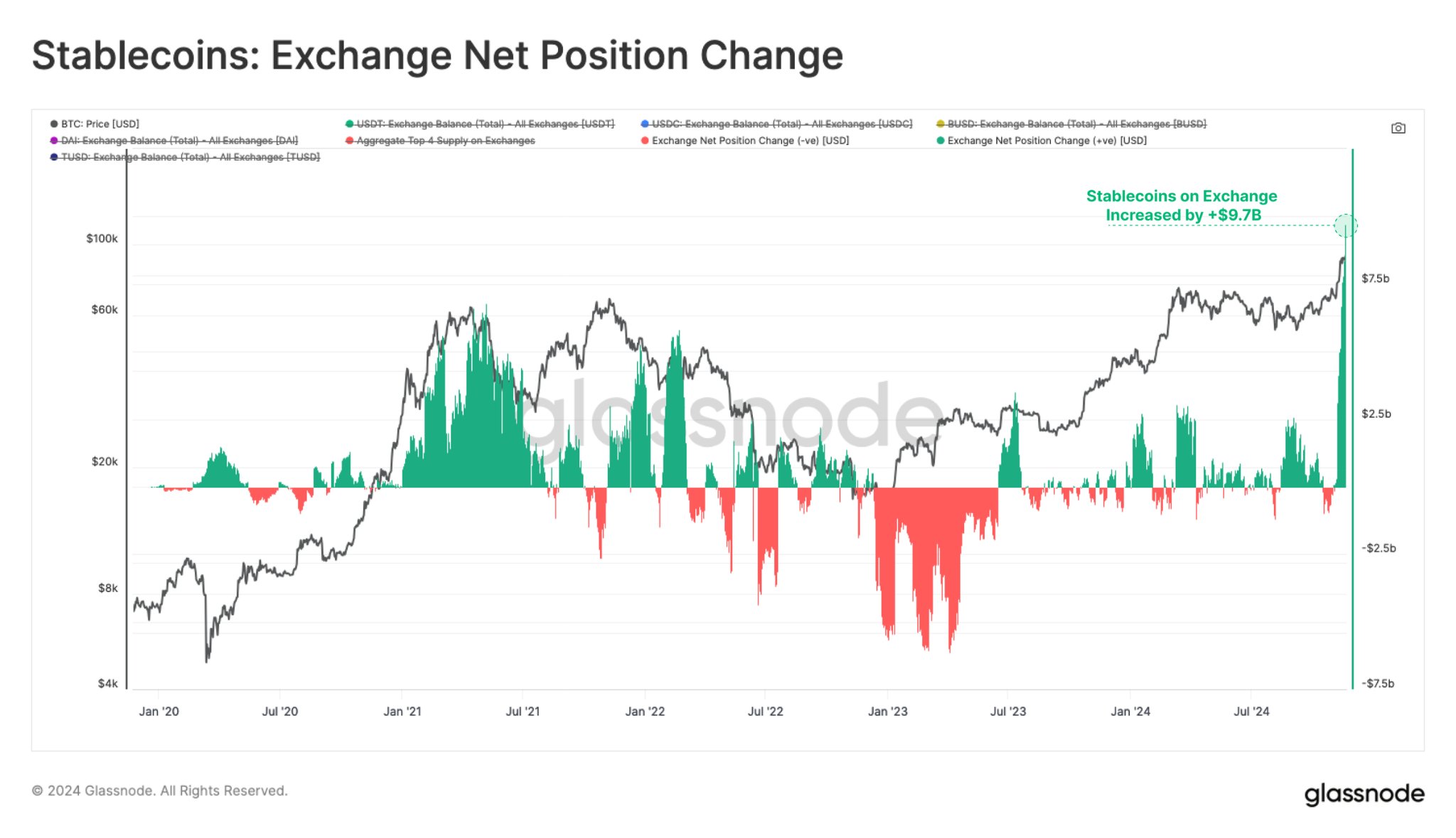

$9.7 Billion Stablecoin Inflows Indicate Potential Bitcoin Price Rally

In the last 24 hours, Bitcoin price #BTC increased by 5%, reaching a new all-time high above $97,500. Notably, stablecoin inflows into the market have surged to a record $9.7 billion over the past month, indicating heightened investor interest.

Stablecoin inflows of nearly $10 billion signal an increase in investor demand, according to Leon Waidmann, head of research at The Onchain Foundation. He stated:

“Stablecoin inflows to exchanges hit $9.7B in 30 days! The LARGEST monthly inflow EVER. Stablecoin liquidity is back. Speculative demand continues to explode!”

-

Courtesy: Leon Waidmann

The rise in stablecoin inflows may lead to increased buying pressure, as these assets are primarily used for converting fiat into crypto. This trend suggests that Bitcoin could soon surpass the $100,000 mark. Analyst Ali Martinez noted that Bitcoin might reach this milestone shortly as it breaks out of a bull flag on the hourly time frame.

#Bitcoin $BTC could reach $100,000 today as it appears to be breaking out of a bull flag on the lower timeframes. pic.twitter.com/UKKcXilHO4

— Ali (@ali_charts) November 21, 2024

Bitcoin Price Forecast of $135,000 with Stablecoin Support

Market analysts are optimistic about BTC's potential for further gains. Analyst Ali Martinez compared Bitcoin’s current behavior to its performance in December 2020, noting similarities in the Relative Strength Index (RSI). If this pattern holds, Bitcoin could reach $108,000, then drop to $99,000 before climbing to $135,000.

-

Courtesy: Ali Charts

Other analysts, including Peter Brandt, noted that BTC has experienced a significant rally from $65,000 to its current levels following the US election results on November 5. After consolidating around $90,000, BTC has broken out again, which could lead to a price surge towards $125,000 and beyond.

-

Courtesy: Peter Brandt

Additionally, Spot Bitcoin exchange-traded funds (ETFs) are contributing to Bitcoin’s price rise. On November 20, US Bitcoin ETFs recorded over $773 million in net inflows, primarily driven by BlackRock’s IBIT, which alone saw $662 million. This marked the sixth consecutive week of net inflows for Bitcoin ETFs, totaling more than $1.67 billion during the trading week of November 11–15.

Data from CoinGlass indicates that Bitcoin futures open interest on the Chicago Mercantile Exchange (CME) reached a record high of 218,000 BTC ($21.3 billion), reflecting a bullish sentiment in the market.