2 0

Standard Chartered Analyst Says ETH Treasury Stocks Outperform ETFs

Standard Chartered analyst Geoff Kendrick stated that companies purchasing ether (ETH) for treasury strategies present a better investment opportunity than ETH spot exchange-traded funds (ETFs).

- These firms attract attention due to their holdings and improving financial structures.

- NAV multiples for ETH treasury companies are normalizing, making them more investable.

- Following Michael Saylor's BTC buying strategy, many publicly traded firms have increased their share prices.

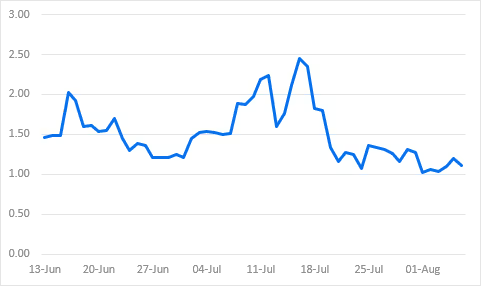

- Top firms include BitMine Immersion Technologies (BMNR) and SharpLink Gaming (SBET), with SBET’s NAV multiple declining from 2.50 to near 1.0.

- Kendrick predicts NAV won't fall below 1.0, as these firms offer regulatory arbitrage opportunities.

- Since June, both treasury companies and U.S.-listed ETFs hold about 1.6% of the total circulating ETH supply.

- Kendrick maintains a year-end price target of $4,000 for ETH, currently trading at $3,652, up 2% in the last 24 hours.