Strategy Adds 1,045 Bitcoin, Raising Total Holdings to 582,000 BTC

MicroStrategy, now rebranded as Strategy, has acquired 1,045 Bitcoin this week, increasing its total holdings to 582,000 BTC. The average purchase price is now $70,086, having previously bought at over $100,000.

Weekly Bitcoin Purchases

- Strategy purchased nearly 2,000 BTC in the last two weeks, spreading buys into smaller amounts.

- This strategy minimizes market disruption and maintains consistent media attention.

- Price movements often follow the company's purchases.

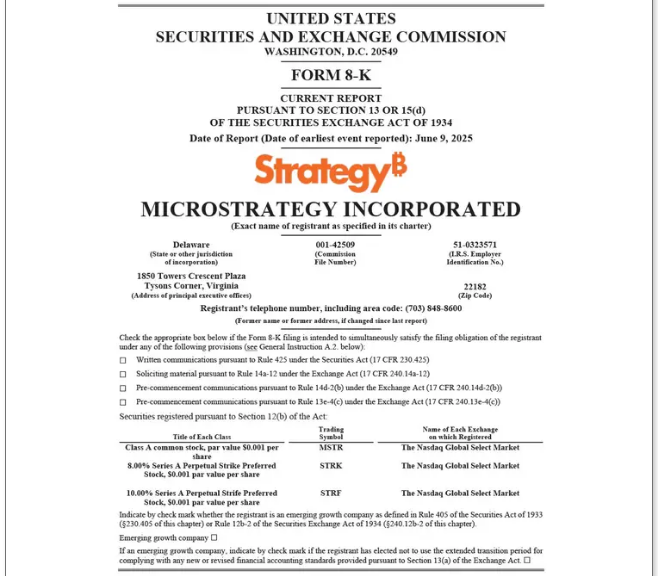

Strategy has acquired 1,045 BTC for ~$110.2 million at ~$105,426 per bitcoin... As of 6/8/2025, we hodl 582,000 $BTC acquired for ~$40.79 billion at ~$70,086 per bitcoin.

Funding came from existing STRK and STRF stocks rather than new MSTR shares, totaling $62.7 million in STRK and $43.3 million in STRF for Bitcoin purchases. This results in approximately 0.02 BTC per MSTR share, significantly higher than competitors.

Market Supply Impact

- Corporate treasuries hold about 3.4 million BTC, reducing available supply on the market.

- Over-the-counter inventories have dropped from 236,000 BTC to 123,500 BTC in a month.

- Coinbase Prime currently lists only 63,535 BTC available.

Corporate Trends and Outlook

- Only 26 public companies hold over 1,000 BTC, with seven exceeding 10,000 BTC.

- Recent activity indicates five more firms have entered Bitcoin purchases, raising total public companies holding BTC to 124.

Investor Implications

Small buys can stimulate demand with lower risk compared to larger orders. However, high average prices pose risks if Bitcoin values decline. Current high interest rates also exert pressure on the market. Strategy's ongoing acquisitions suggest scarcity, reinforcing that major holders are not selling.