12 1

Tariff Impact Boosts Bitcoin’s Role as Store of Value

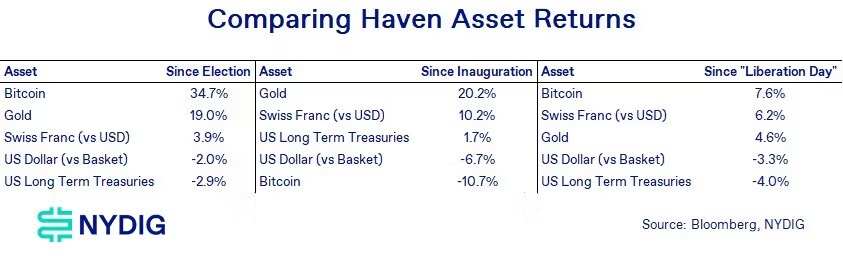

April has seen significant volatility for traders, largely due to conflicting headlines about tariffs from President Trump and uncertainty in asset safety. Amidst this turmoil, bitcoin emerged as a potential safe haven asset.

- NYDIG Research noted that traditional safe havens like the US dollar, US Treasuries, Swiss Franc, and gold struggled during this period.

- Bitcoin's performance since April 2, when tariff announcements initiated market volatility, indicates its growing role as a store of value.

- NYDIG highlighted bitcoin's shift away from behaving like a leveraged equity beta toward acting more like a non-sovereign store of value.

- The trend suggests investors are reconsidering bitcoin amidst the "sell America" sentiment.

- While the connection remains tentative, bitcoin is beginning to fulfill its intended purpose as a reliable store of value in turbulent times.