5 0

BULLISH 📈 : Tether Plans up to 15% Gold Allocation Amid Record Prices

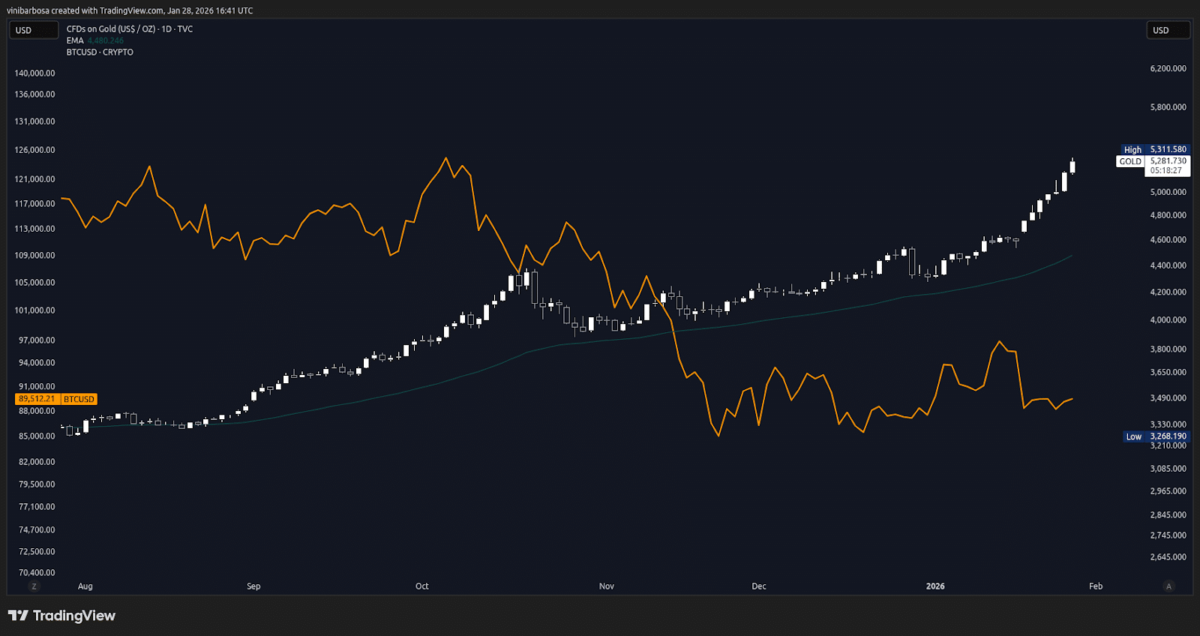

Tether, a major stablecoin issuer, plans to increase its gold holdings, potentially surpassing its Bitcoin allocation. This decision comes as gold prices reach new highs, while Bitcoin lags.

- Tether aims to allocate 10-15% of its portfolio to gold and 10% to Bitcoin.

- The company issues stablecoins backed by assets like the US dollar or gold.

- Tether is the largest issuer of USD and gold-backed stablecoins, USDT and XAUT.

- Tether has amassed approximately 140 tons of gold, valued at around $24 billion.

Gold recently surpassed $5,000 per ounce, achieving an all-time high and continues to rise. In contrast, Bitcoin trades at $89,500, about 30% below its peak of $126,000.

Tether's strategy reflects market conditions where gold is seen as a safer asset amid global uncertainty.