7 0

Tether Expands Gold Reserves as Profits Surpass $10 Billion

Key Points:

- Tether is expanding beyond stablecoins by establishing a commodities desk and increasing its gold reserves.

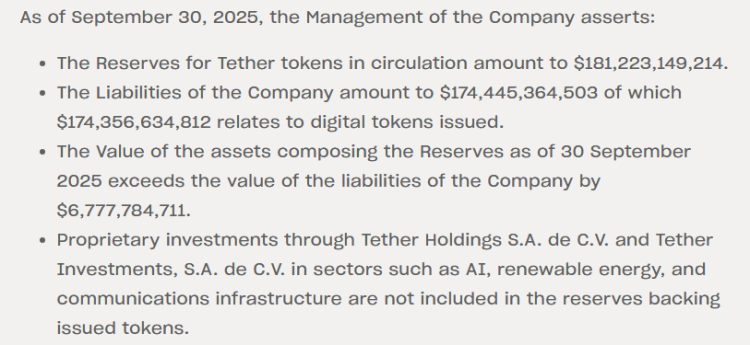

- The company's Q3 report shows profits over $10B and a balance sheet exceeding $181B.

- Notable personnel moves include hiring senior metals leaders from HSBC to lead the new commodities unit.

Market Implications:

- Tether's expansion into commodities could signal a shift towards broader financial services in crypto.

- Potential impact on trending cryptocurrencies like Bitcoin, Bitcoin Hyper ($HYPER), Best Wallet Token ($BEST), and Polkadot.

- $DOT is positioned for cross-chain operations as flows extend beyond Ethereum and Solana.

Highlighted Cryptos:

- Bitcoin Hyper ($HYPER): Focuses on secure, fast transactions using Bitcoin's network.

- Best Wallet Token ($BEST): Provides utility within an active Web3 wallet with features like reduced fees and early access to sales.

- Polkadot ($DOT): Offers cross-chain capabilities with potential value growth from increased tokenized asset adoption.

Conclusion: Tether's move into commodities points to a broader trend of integrating traditional finance with crypto infrastructure, potentially benefiting the highlighted cryptocurrencies through enhanced utility and market dynamics.