4 0

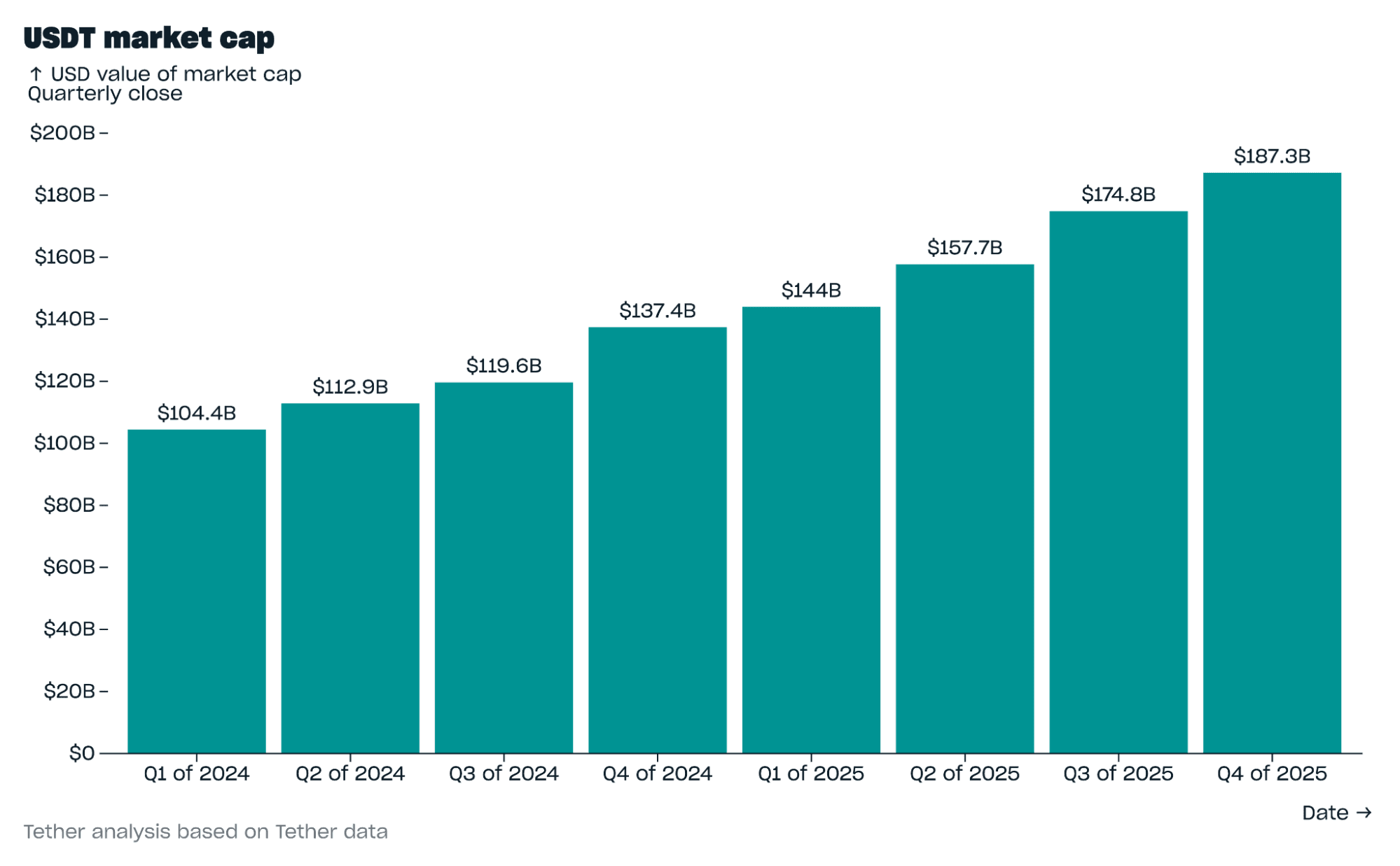

BULLISH 📈 : Tether USDt Hits $187B Market Cap as $MAXI Attracts Traders

- Tether's market capitalization has reached a record $187 billion, signifying substantial liquidity available for investment in risk assets.

- Market trends show capital moving from stablecoins to high-risk tokens, benefiting projects with compelling narratives.

- Maxi Doge ($MAXI) aims to capitalize on this trend by offering unique "leverage culture" utilities and trading competitions.

- Over $526k has been raised for a new L3 protocol, indicating smart money's interest in early-stage utility projects.

The rapidly growing Tether (USDt) market cap suggests an influx of institutional liquidity poised for investment in high-beta assets. This could lead to significant price movements in major cryptocurrencies and subsequently more speculative assets.

Retail traders are already engaging in this rotation, focusing on assets that align with the current cycle's "leverage culture." Projects like Maxi Doge have gained traction as they offer high-risk, high-reward opportunities.

Maxi Doge's Strategy

- Maxi Doge promotes a "1000x leverage" mentality, catering to retail traders seeking high returns.

- It integrates trading competitions and uses a "Maxi Fund" treasury to provide liquidity and potential integrations with futures platforms.

- This approach mirrors professional trading environments while maintaining a viral aesthetic popular on crypto social media.

Presale Success and Staking Incentives

- Maxi Doge has raised over $4.5 million during its presale, reflecting strong market interest.

- The token's pricing structure offers growth potential compared to other meme assets.

- Staking mechanics encourage asset locking, reducing circulating supply and potentially enhancing token value.

Overall, the combination of large-scale accumulation and staking incentives presents a promising scenario for Maxi Doge amidst expanding liquidity in the crypto market.