11 0

Tokenized Apollo Credit Fund Launches DeFi Levered-Yield Strategy

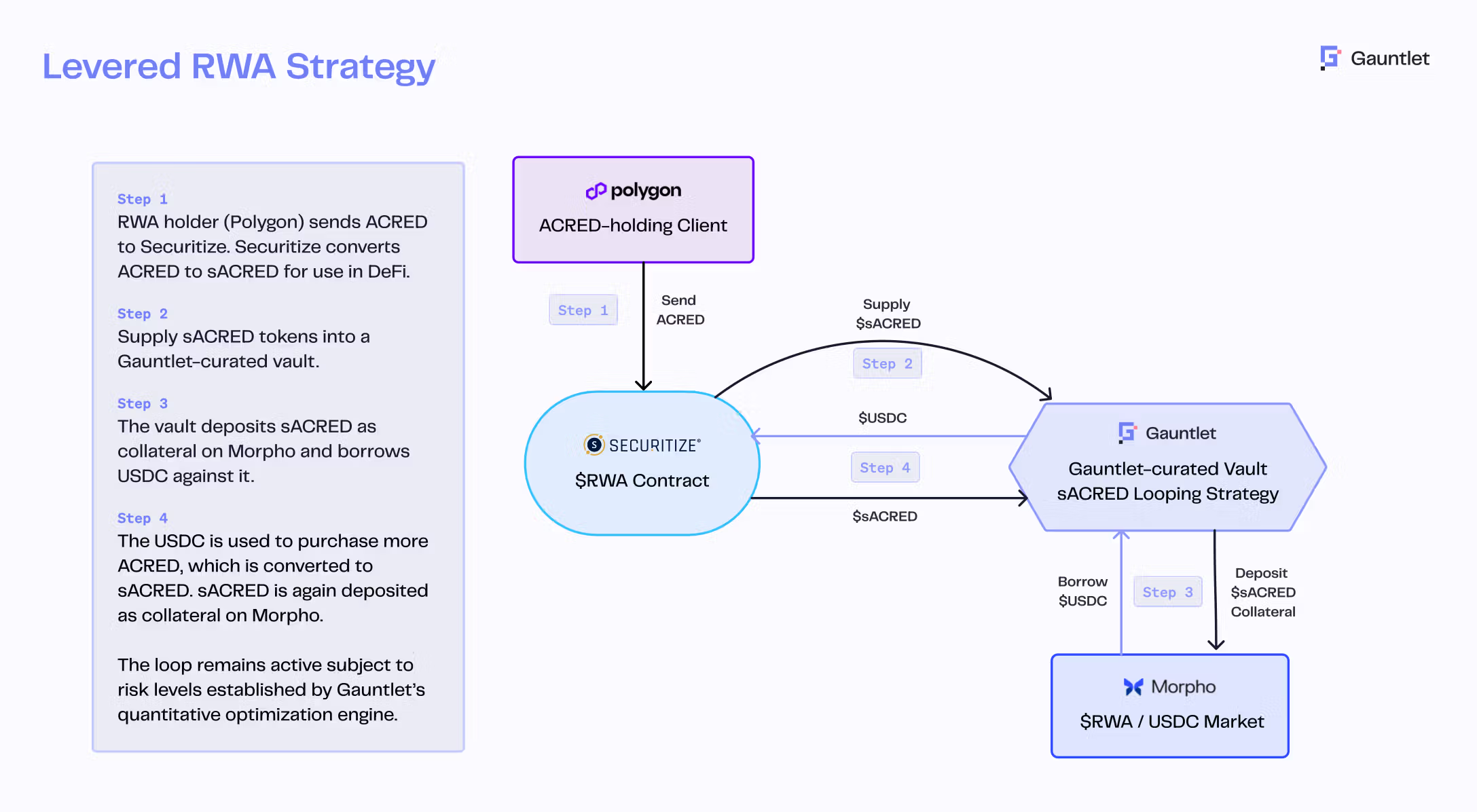

Tokenization firm Securitize and DeFi specialist Gauntlet are launching a tokenized version of Apollo's credit fund, the Apollo Diversified Credit Securitize Fund (ACRED), to integrate real-world assets into the crypto space. The new offering, called Levered RWA Strategy, will utilize a leveraged-yield strategy on Compound Blue, starting on the Polygon blockchain before expanding to Ethereum and others.

Key points include:

- Leveraged-yield strategy utilizes ACRED tokens as collateral to borrow USDC for purchasing more ACRED, enhancing yield through a process known as "looping."

- All transactions are automated via smart contracts, minimizing manual oversight.

- Gauntlet’s risk engine actively manages leverage ratios to protect users in volatile markets.

- Securitize’s sToken tool ensures compliance for accredited token holders, allowing broader DeFi strategies.

- Institutional interest in tokenized assets is rising, with firms like BlackRock and HSBC exploring blockchain-based issuance.

This initiative aims to enhance access to institutional-grade DeFi solutions for investors, aligning with trends in traditional finance towards tokenization.