8 0

Tom Lee Predicts Ethereum Could Reach $62,500 Based on Ratio Analysis

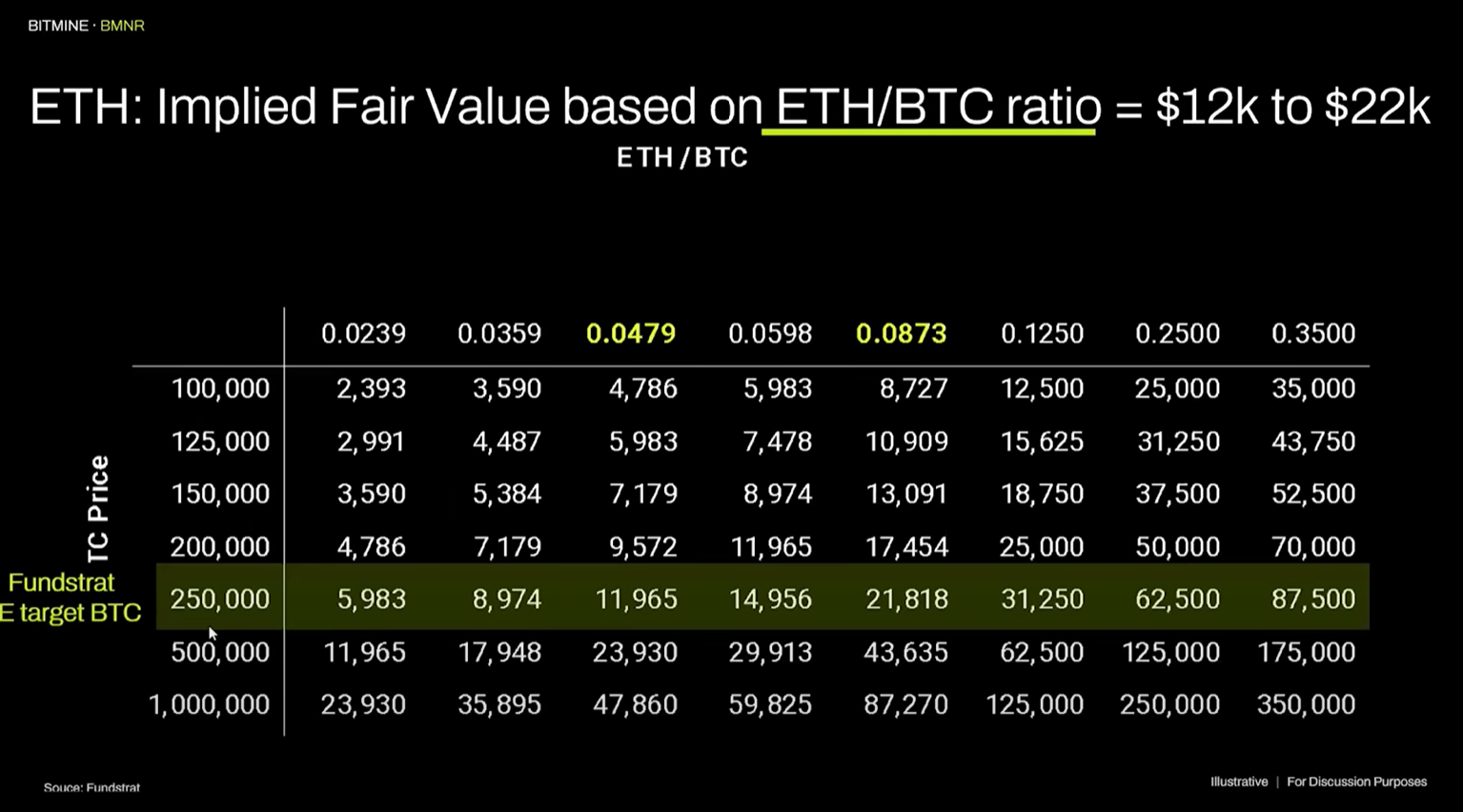

Tom Lee, chairman of BitMine, analyzed Ethereum's potential upside using a ratio framework and "replacement-cost" perspective on payment systems. He suggests that if Bitcoin reaches $250,000 by year-end, Ethereum could range from $12,000 to $22,000 based on the ETH/BTC ratio.

Key Points on Ethereum's Potential Upside

- Current ETH/BTC ratio is 0.0432, below the 8-year average of 0.04790.

- The all-time high ratio was 0.0873.

- At $250,000 for Bitcoin, Ethereum could reach approximately $12,000 at the average ratio and around $22,000 at its 2021 high ratio.

- A "replacement-cost" analysis indicates Ethereum could be valued at around $60,000 if it becomes foundational for payment networks and tokenized assets.

- This leads to a potential target of $62,500 for Ethereum if it replaces existing financial infrastructures.

- Lee emphasizes the importance of both Bitcoin and Ethereum metrics, as Ethereum captures significant financial activity and aligns well with institutional needs.

- BitMine's strategy focuses on enhancing ETH holdings through various financial mechanisms linked to proof-of-stake economics.

As of the latest update, Ethereum is priced at $4,377.