16 1

Trader Mayne Anticipates Bitcoin Bull Cycle Top by Late 2025

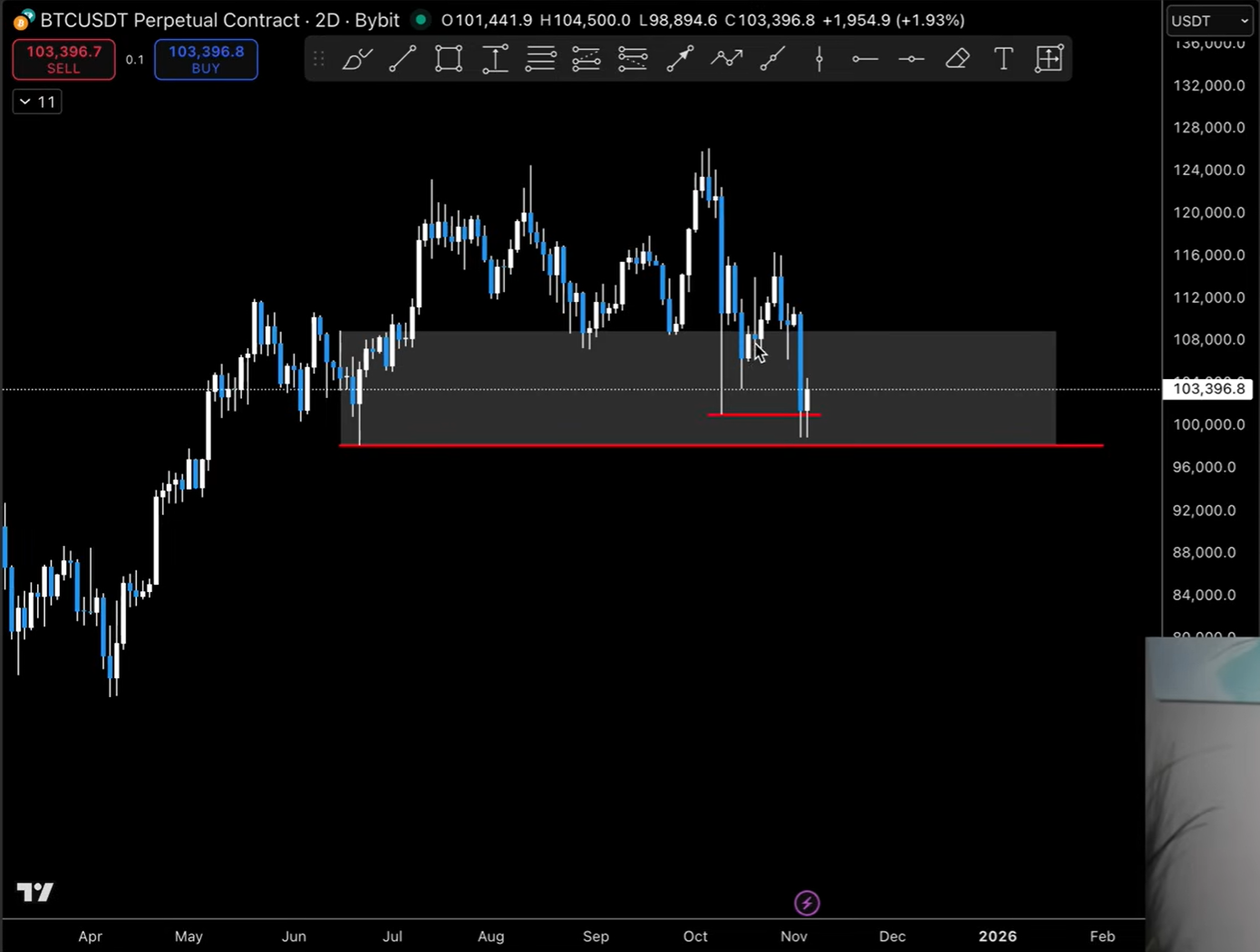

Veteran crypto analyst Trader Mayne maintains that the bull cycle's top is not reached yet, despite recent volatility and billion-dollar liquidations. He anticipates a weekly cycle low soon, potentially leading to a year-end market rise.

Bitcoin's Market Dynamics

- Mayne views the recent selloff as part of late-cycle price discovery, with speculative leverage in altcoins and major cryptocurrencies offering clearer structure.

- He uses cycle theory, expecting the broader crypto top between late 2025 and early 2026, while focusing on finding a weekly low by mid-November.

- A reclaim of the monthly open around $110,000–$112,000 could confirm the decline's end, with $98,000 as a bull-market invalidation point.

Cross-Asset Analysis

- Gold's rally, now 80–90 days old, might signal Bitcoin's next move within 60–90 days, suggesting Bitcoin may outperform gold through the year-end.

- Mayne notes the absence of a "blow-off" in Bitcoin, unlike AI-heavy equities and gold, indicating potential upside if a weekly low forms.

Market Structure and Risks

- Early-month dynamics could lead to a higher November close if an early-month low and monthly-open reclaim occur.

- Mayne acknowledges bear signals such as weekly structure breaks and momentum divergences, warning of potential distribution by larger players.

- Two macro scenarios: classic four-year rhythm with a cycle top in late 2025 or an atypical extension into Q1 2026.

- The US dollar's strength poses a risk for 2026, potentially pressuring crypto markets.

At press time, Bitcoin traded at $103,412.