8 0

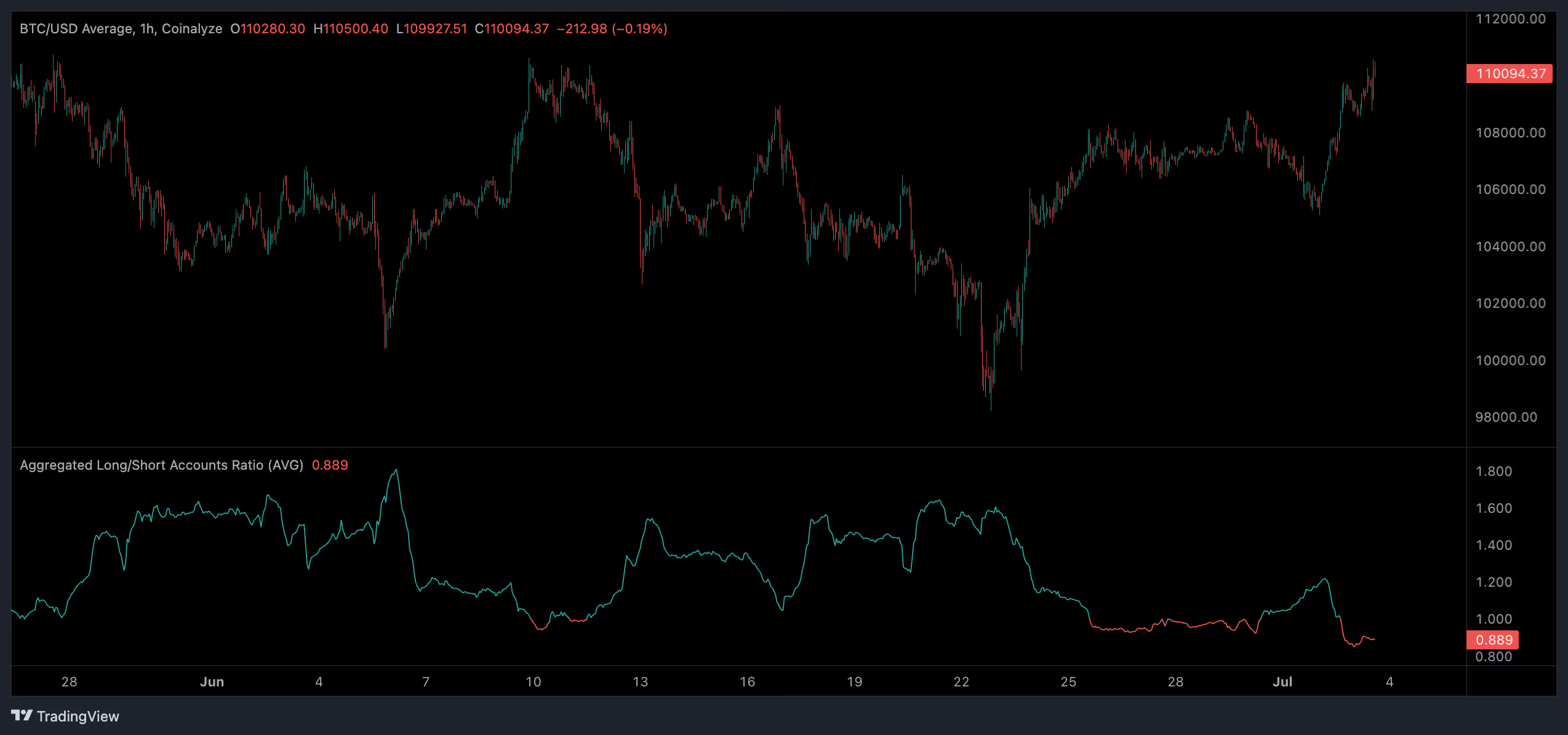

Traders Increase Short Positions Despite Bitcoin Trading Above $110,000

Crypto traders are showing bearish tendencies even as bitcoin trades above $110,000 and approaches a potential record high beyond $112,000.

- The long/short ratio decreased from 1.223 to 0.858, indicating a shift from longs to shorts during bitcoin's recent rise from $106,000 to $110,000.

- Open interest increased from $32 billion to $35 billion, suggesting significant capital is being allocated to short positions.

- Bitcoin has remained within a range of $100,000 to $110,000 since early May, encountering resistance and support at these levels.

- Technical indicators reveal bearish divergence with the relative strength index (RSI) weakening on tests of $110,000.

- The influx of short positions may reflect lower timeframe traders shorting resistance before reversing at support levels.

- A potential bull case exists for a short squeeze if liquidation points trigger buy pressure above the record high.