Updated 17 December

TRON Achieves $587 Billion in USDT Transfers in November 2024

The market activity of TRON (TRX) has surged significantly, with a record $587 billion in USDT transfers in November 2024, marking a 30% increase from previous months.

This expansion highlights TRON's position as a leading blockchain platform for stablecoin transactions, characterized by rapid transaction speeds and low fees. The deflationary model and increasing popularity of stablecoins may contribute to further price increases in the evolving cryptocurrency market.

USDT Transfer Volume on TRON Reaches All-Time High of $587.2B (Monthly)

“Stablecoins have seen remarkable growth, driven by strong interest in cryptocurrencies over recent months. TRON has emerged as the leading blockchain for stablecoin transfers.

This chart highlights the… pic.twitter.com/150KEggTlK

— CryptoQuant.com (@cryptoquant_com) December 14, 2024

Further Growth & Technical Analysis

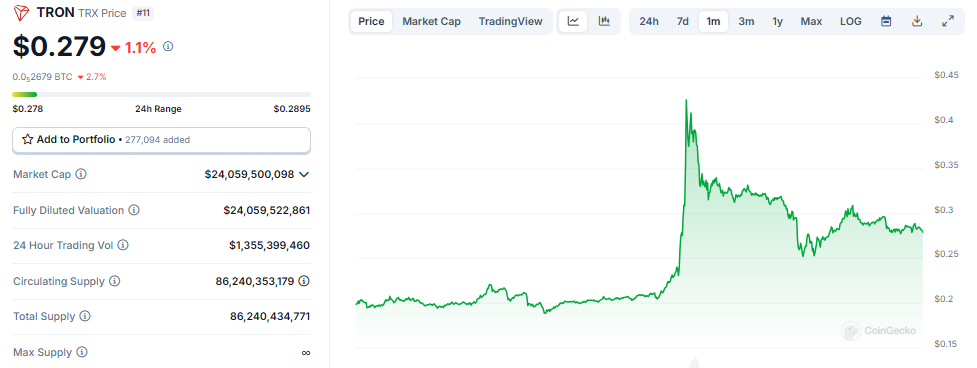

Currently trading at $0.279, TRON has shown upward momentum after reversing from a support level of approximately $0.2400. Analysts expect it to surpass the resistance level of $0.3200, which hindered its price in early December.

The positive sentiment in crypto markets supports this outlook, indicating that TRON might continue its upward trend. With a market capitalization exceeding $35 billion, its growth reflects a broader trend of capital flowing into established cryptocurrencies amid market volatility.

Expert Foresees A Promising Future

Andrew Griffiths, a cryptocurrency expert, predicts that TRON could reach $3 to $5 due to its rising acceptance as a stablecoin and payment tool. The increasing demand for USDT may enhance TRON's role in the cryptocurrency market.

#TRX TRON is heading towards its apex, once it squeezes at that level, it will blow out, this will happen sooner than later, possibly in the next few months, target is 3-5 USD with an insanely deflationary model and the fastest blockchain for payment processing, nothing is… pic.twitter.com/b0xhgqhABT

— Andrew Griffiths (@AndrewGriUK) December 13, 2024

TRON's performance has attracted investors seeking reliable returns and developers creating decentralized applications (dApps) due to its capable infrastructure, supporting thousands of transactions per second.

TRON is expected to maintain its growth trajectory amid ongoing advancements in the cryptocurrency sector, including technological upgrades and partnerships.

The Road Ahead

TRX recently peaked at $0.45, doubling its valuation overnight and raising its market value to $39 billion. Founder Justin Sun's strategic $30 million investment in World Liberty Financial has improved the company's trajectory, solidifying TRON's position in the blockchain landscape.

Featured image from Fast Company, chart from TradingView