Trump’s Crypto Portfolio Valued at $6.9 Million with Ethereum Gains

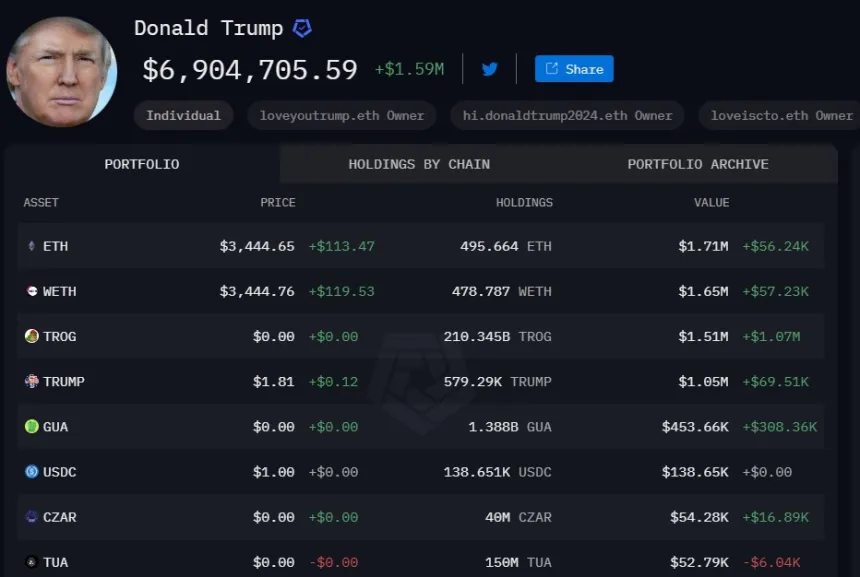

Recent data from market intelligence firm Arkham Intel indicates that President-elect Donald Trump’s crypto portfolio has experienced notable gains, aligning with a significant rise in crypto prices following his election victory on November 5.

Although Bitcoin (BTC) is central to Trump's presidential campaign, he holds approximately 496 coins of Ethereum (ETH), which has seen a 38% increase over the past thirty days.

Trump’s Crypto Holdings Shine

Crypto analyst Michael van de Poppe noted a bullish divergence on Ethereum's daily chart, indicating favorable market conditions for further growth. He identified a drop in government bond yields as a key factor driving ETH's recent performance, suggesting that lower yields encourage investor interest in riskier assets like Ethereum.

Van de Poppe elaborated that fluctuations in yield markets could significantly affect Ethereum's trajectory. With Labor Market Week approaching, weak economic indicators may prompt the Federal Reserve to implement rate cuts, potentially boosting Ethereum's price further.

Analyst Jesse Olson supported this positive outlook, noting that Ethereum's dominance over Bitcoin shows signs of bullish divergence, indicating potential buying opportunities for ETH.

As a result, Trump’s crypto holdings have increased by nearly $1.6 million within the past 24 hours, reflecting positive market sentiment around Ethereum and other tokens in his portfolio.

Major Investment From TRON Founder

In a related development, crypto entrepreneur Justin Sun has invested $30 million in Trump’s World Liberty Financial, a decentralized finance (DeFi) project. Sun, founder of the TRON cryptocurrency, expressed his support for Trump's vision of transforming the US into a blockchain hub, emphasizing TRON's commitment to innovation and financial democratization.

World Liberty Financial aims to raise $300 million at a valuation of $1.5 billion. However, it has revealed that its WLF token offerings are primarily marketed offshore, with only $30 million allocated for US investors. Once this amount is reached, the US offering will close despite remaining tokens available for sale.

Additionally, Trump is reportedly in discussions to acquire the digital asset marketplace Bakkt Holdings Inc. through Trump Media & Technology Group Corp., which he controls.

At the time of writing, ETH was trading at $3,435, reflecting a 2.4% increase over the last 24 hours.

Featured image from CFR, chart from TradingView.com