24 0

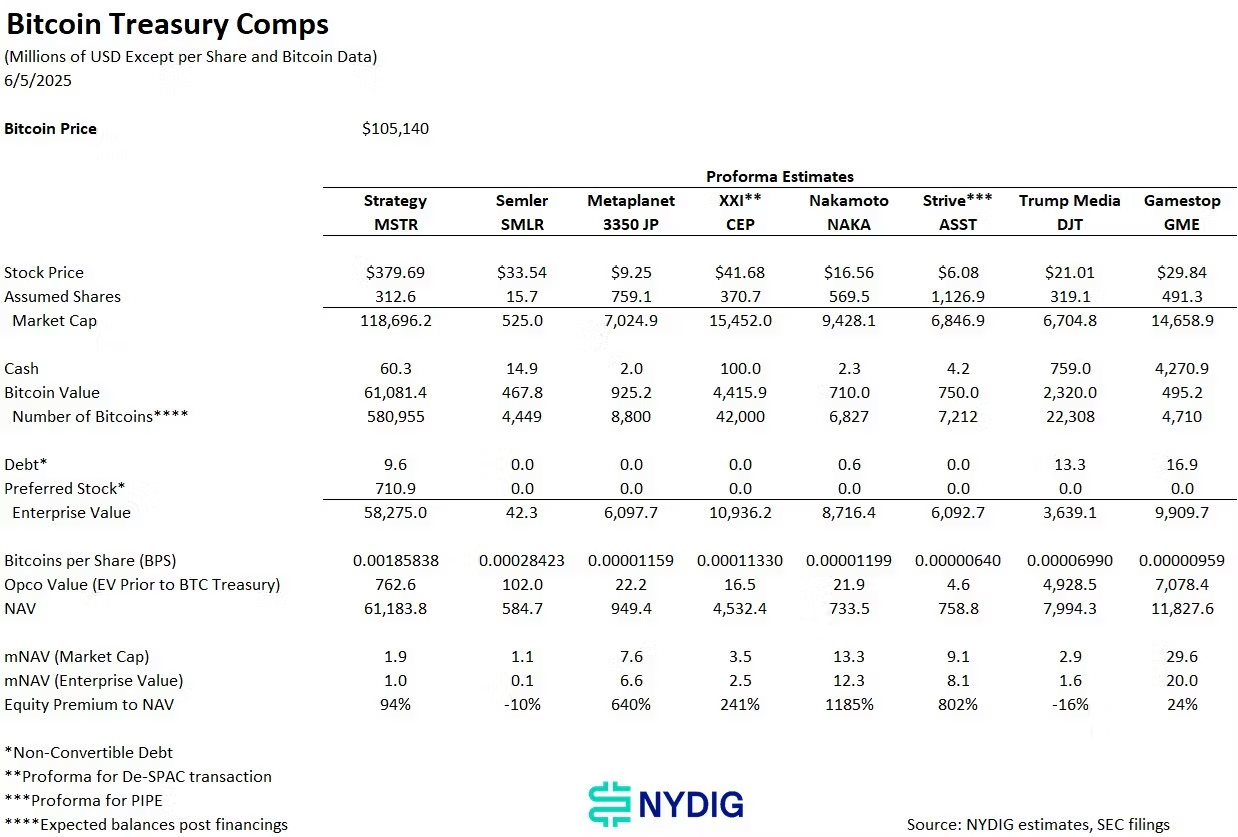

Trump Media and Semler Scientific Show Lowest Equity Premium to NAV

A surge in bitcoin treasury companies is occurring, with firms focusing on accumulating bitcoin. These companies are following the strategy of MicroStrategy (MSTR), raising questions about their valuation and comparison.

- The key metric for assessing a bitcoin treasury is its premium relative to net assets, including operating company values.

- Greg Cipolaro from NYDIG emphasizes calculating total bitcoin, cash, and enterprise value while deducting obligations like debt.

- One common metric, mNAV, compares a company's valuation to its net asset value, where an mNAV above 1.0 indicates a premium interest in the stock.

- Cipolaro suggests mNAV is insufficient alone; other metrics like NAV, mNAV by market cap, and equity premium to NAV should be considered.

- The analysis shows that Semler Scientific (SMLR) and Trump Media (DJT) have low equity premiums despite high mNAVs.

- On Monday, SMLR and DJT remained stable while bitcoin increased to $108,500.