Trump’s Return to Office Boosts Bitcoin Market Confidence

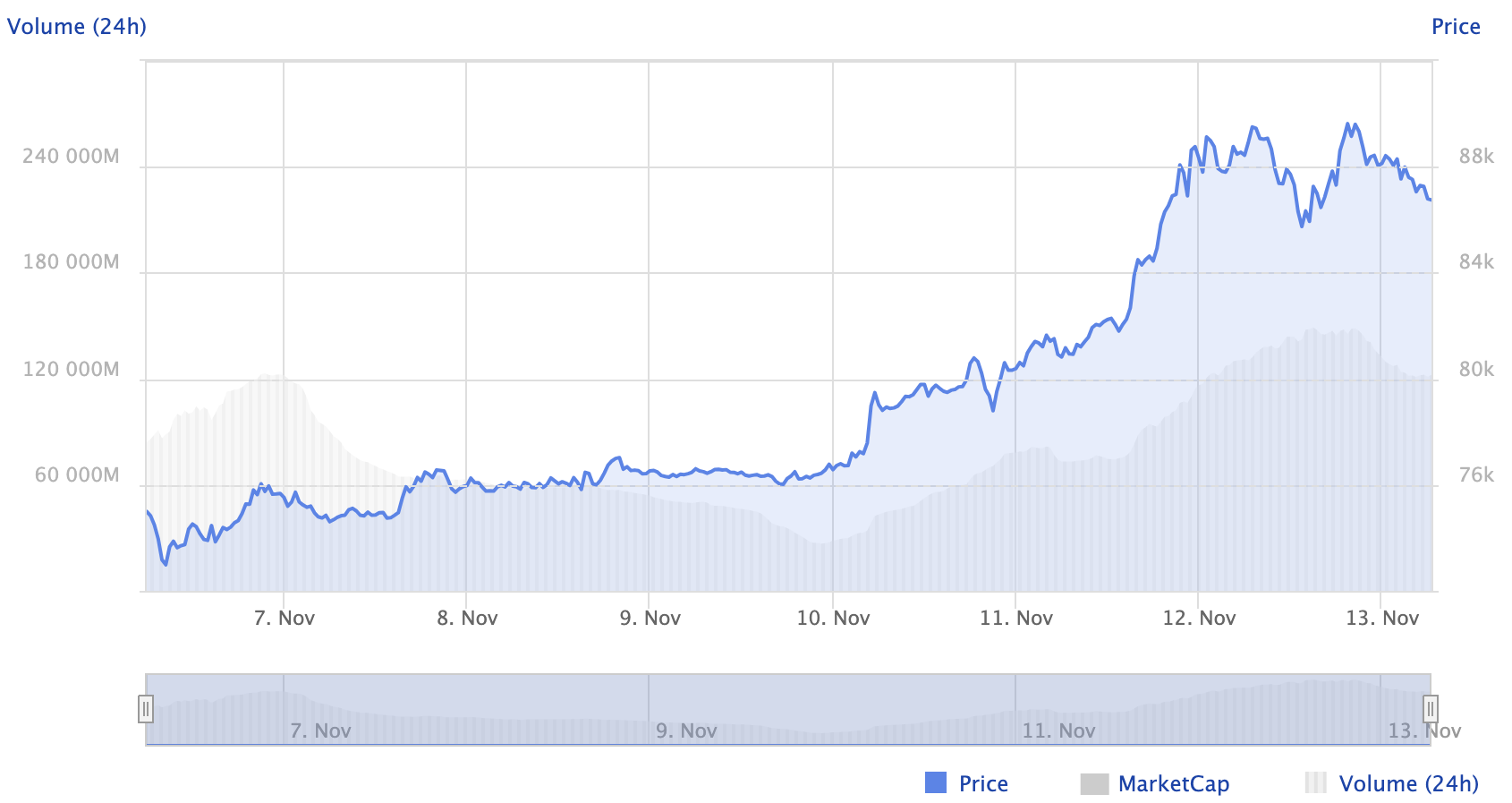

The recent U.S. presidential election, resulting in Donald Trump returning to office, has generated optimism for Bitcoin (BTC) and the broader cryptocurrency market. Historically, Bitcoin's value tends to rise following U.S. elections, and the 2024 election has continued this trend. The election outcome has reinforced Bitcoin’s status as a resilient digital asset, with its price notably increasing after the results were announced.

Trump's return to the Oval Office impacts the crypto market significantly due to his administration’s supportive stance toward Bitcoin. He has expressed intentions to establish the U.S. as a "Bitcoin superpower," indicating support for Bitcoin growth and aiming to position the U.S. as a leader in the cryptocurrency sector. This outlook from a major economy enhances Bitcoin’s appeal, driving renewed investment interest.

Confidence in Bitcoin is also evident in the substantial capital inflow into cryptocurrency exchange-traded funds (ETFs), boosting its market capitalization and underscoring its growing financial significance. This trend reflects increased institutional interest, backed by Trump's administration, in a previously skeptical market.

Globally, nations such as Bhutan are increasing their Bitcoin investments, highlighting that Bitcoin's growth extends beyond U.S. policies. This international interest signifies Bitcoin’s evolution into a versatile asset appealing to diverse investors with potential for long-term economic growth.

With Trump’s administration, anticipation grows for policies promoting Bitcoin's integration into the mainstream financial system. Potential regulatory frameworks and infrastructure developments may emerge, fostering greater government participation in the cryptocurrency ecosystem.

In summary, Trump’s return invigorates the crypto market, positioning Bitcoin as a strong asset for global investors. This election result has catalyzed renewed confidence in Bitcoin, viewed by both retail and institutional investors as a hedge against traditional economic uncertainties. As Trump’s administration embraces Bitcoin, it appears poised to embark on a new chapter as a prominent global financial asset.