0 0

Trump’s Tariff Threat Triggers Crypto Market Sell-Off and Liquidations

Bitcoin dropped to $91,920, down 3.8% from $95,500, as geopolitical tensions impacted the crypto market. Ether fell by 5.3% to $3,177, while XRP and Solana saw declines of 10.4% and 9%, respectively.

Key Factors Affecting Crypto Market

- President Trump's announcement of additional tariffs on imports from several European countries triggered market volatility.

- European leaders criticized the move, calling it "blackmail," and warned it could damage transatlantic relations.

- French President Macron threatened to use the EU's "anti-coercion instrument" against the US.

The immediate impact of these announcements led to a global repricing of risk, affecting liquid markets like crypto.

Market Dynamics

- On-chain indicators showed strong selling pressure, particularly among US "whales," not linked to ETF activities.

- The Coinbase Premium Gap indicated increased selling pressure in US markets compared to international platforms.

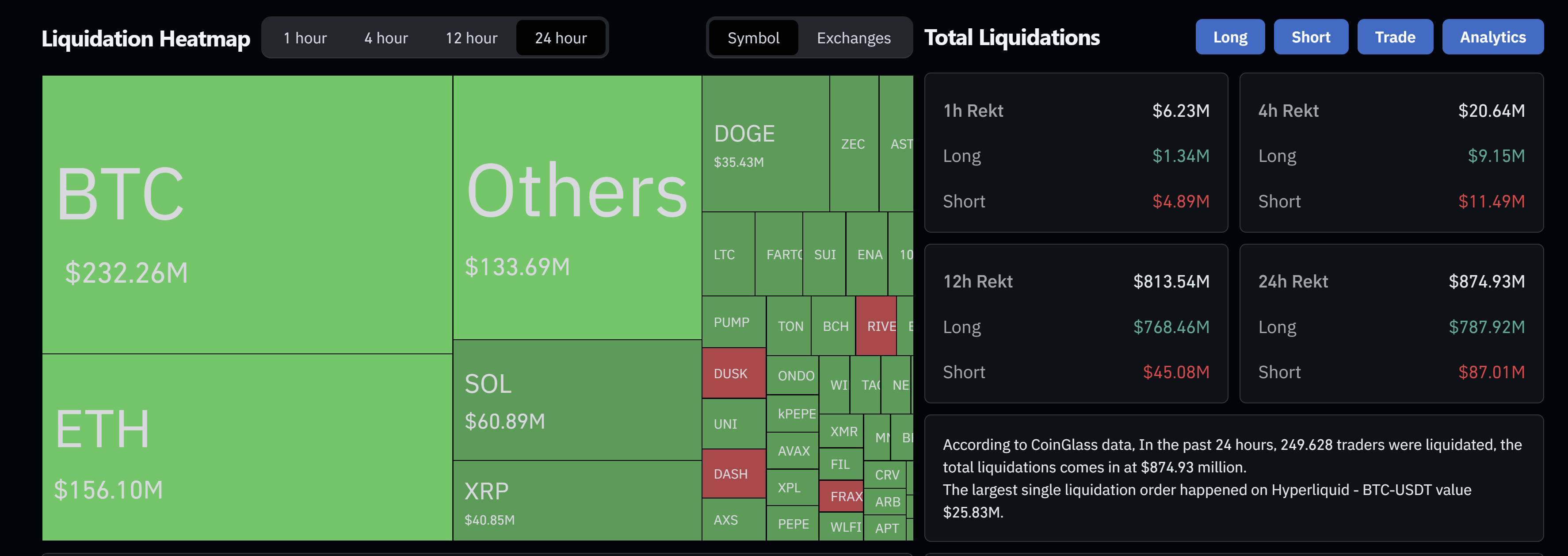

- Futures liquidations totaled $874.93 million, with longs accounting for $787.92 million, reflecting forced closures as prices fell.

Bitcoin has since recovered to $93,000.