U.S. Likely to Hit Debt Ceiling Between January 14 and 23

Treasury Secretary Janet Yellen indicated that the U.S. is expected to reach its borrowing limit between Jan. 14 and Jan. 23. Following this, the Treasury will implement "extraordinary measures" to manage borrowing. In her letter to House Speaker Mike Johnson, she urged Congress to act to maintain the nation's creditworthiness. Congress previously suspended the debt limit until Jan. 1, 2025.

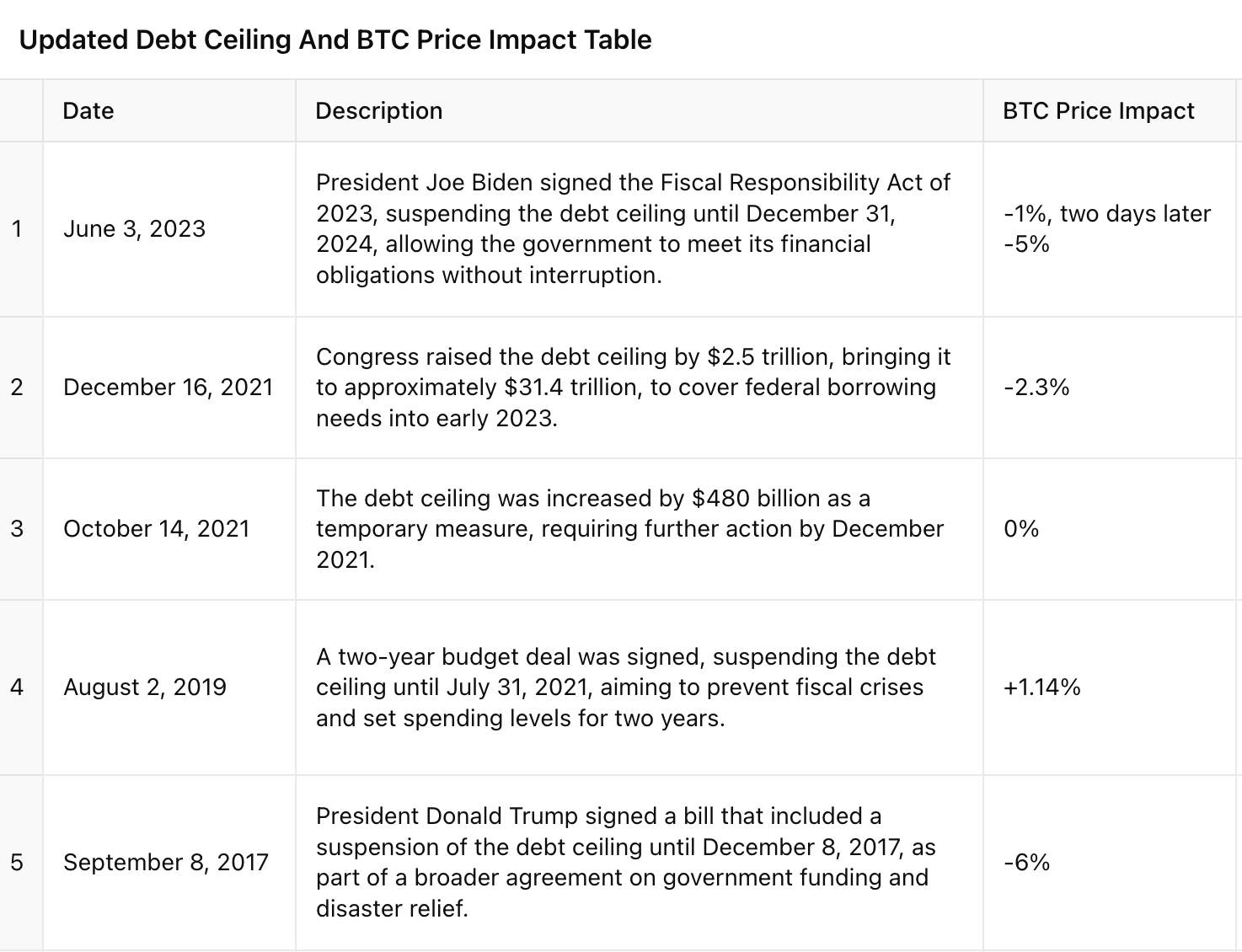

Market reactions were negative, with U.S. equities declining approximately 1% for the S&P 500, Nasdaq 100, and Dow Jones Industrial Average just before the letter was released. Bitcoin experienced a drop of up to 4% from its intraday high. Historically, raising the debt ceiling has been associated with negative performance for Bitcoin, which has underperformed on the five occasions following similar events.

Bitcoin's performance in December has also been weak, showing a decline of 3%, marking its first negative month since August. The political context is further complicated by President-elect Donald Trump's inauguration on Jan. 20, coinciding with the period Yellen identified.

Historically, Congress established a debt limit in 1939, raising it 103 times as government spending has exceeded tax revenues, with the current national debt exceeding $36.2 trillion.

Bitcoin's price movements are also influenced by previous market cycles. Since the low during the FTX collapse in November 2022, BTC has followed patterns similar to past cycles, currently showing nearly a 500% return. However, this alignment raises concerns for bullish investors, as both the 2018-2022 and 2015-2018 cycles experienced significant downturns at this stage. Notably, Trump's inauguration on Jan. 20 could potentially indicate a bottom for Bitcoin.