Uniswap Price Remains at $16 Amidst $104M Whale Token Offloading

Bitcoin has dropped below $104K, causing increased selling pressure on altcoins. Despite this, Uniswap maintains a positive trajectory, trading above $16.

The market correction suggests an influx of supply as DeFi tokens remain stable. The key question is whether Uniswap will fall below $15 amidst Bitcoin's potential decline to $100K.

Whales Offload Massive Supply of Uniswap

Institutions are realizing profits in their DeFi tokens amid the market correction. Recently, institutions have deposited UNI tokens across multiple exchanges.

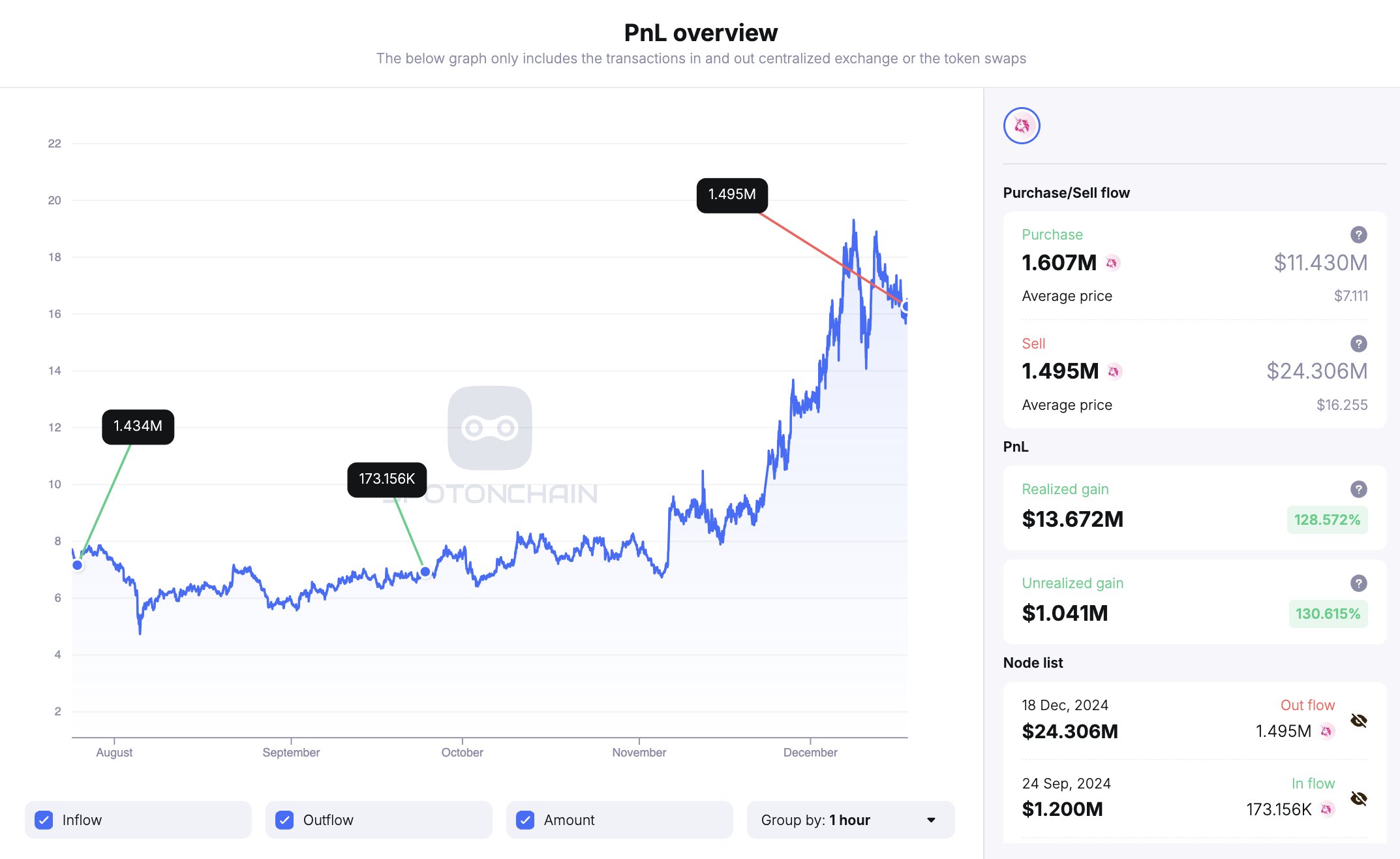

A whale known as “0x59A” deposited 1.495 million UNI tokens worth $24.3 million on Binance, securing a profit of $13.7 million, a return of 129% over five months.

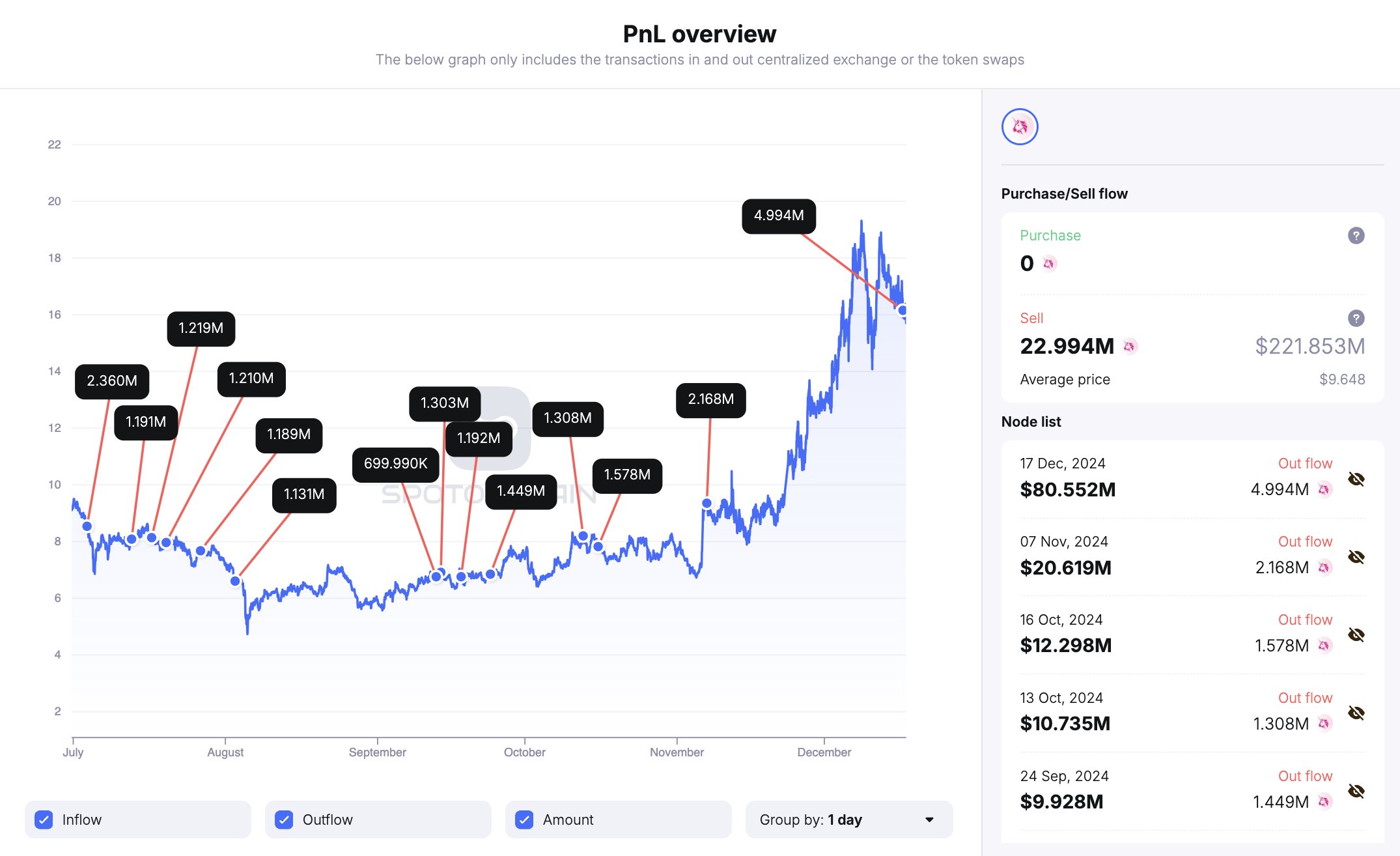

Additionally, a wallet associated with the Uniswap team, “0x837,” transferred nearly 5 million UNI tokens worth $80.97 million on Coinbase Prime after 4.25 years of inactivity, indicating strategic timing amid market volatility.

Post-deposit, the team wallet retains $65.7 million in UNI tokens. Three dormant wallets linked to Uniswap have reactivated since July 4, depositing 22.99 million UNI tokens valued at $221.85 million, averaging $9.648 per token.

In the last 24 hours, over 800,000 UNI tokens worth more than $13 million have been sent to exchanges.

Uniswap Pictures Triangle Breakout to Cross $20

The 4-hour chart indicates that Uniswap is testing a support trendline, forming a symmetrical triangle pattern.

Currently trading at $16.32 with a 0.48% intraday gain, Uniswap shows resilience despite the supply pressure from whale deposits.

Indicators suggest a potential breakout rally, with the MACD ready for a positive crossover. A bullish breakout could challenge the $19.45 resistance level, and if extended, may reach $24.71. Support remains critical at $14.19 to maintain upward momentum.

In summary, Uniswap displays potential for a breakout rally while navigating broader market pressures.