8 0

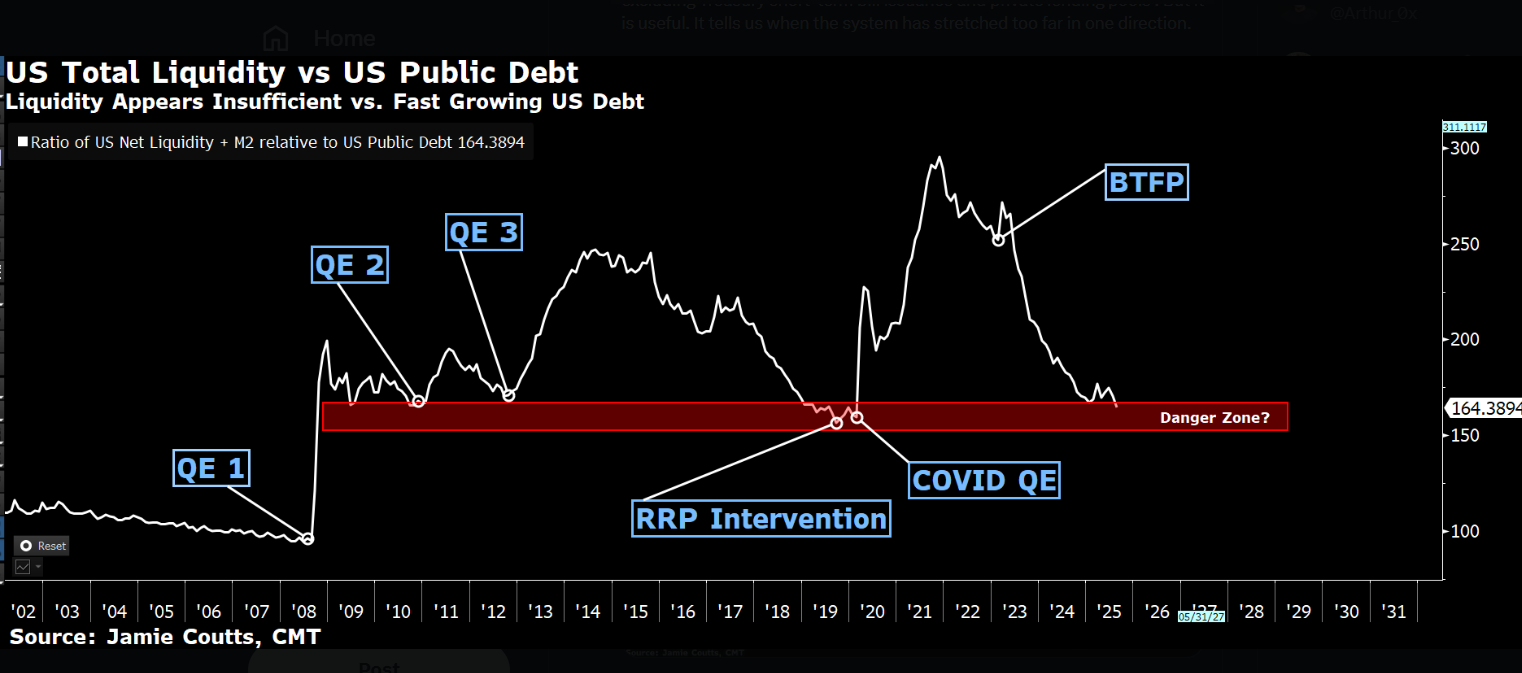

US Debt Growth Surpasses Liquidity, Raising Financial Stability Concerns

The current imbalance between US debt growth and liquidity may indicate vulnerabilities in the financial system. Key points include:

- US debt is increasing faster than liquidity.

- Low liquidity can heighten funding pressure on risk assets, including equities and crypto.

- Similar low liquidity ratios were seen before the 2019 repo crisis, prompting emergency Fed interventions.

- This situation suggests fragility in financial infrastructure.

- Persistent debt growth could lead to renewed funding stress.

- Short-term shocks may lower crypto prices as investors reduce risk.

- Long-term liquidity issues could push central banks toward easing, benefiting Bitcoin and digital assets.