7 0

US Investors Lead Bitcoin Selloff Amid Market Downturn, CryptoQuant Reports

The recent market downturn has been characterized by significant selling from US Bitcoin investors, as evidenced by key indicators:

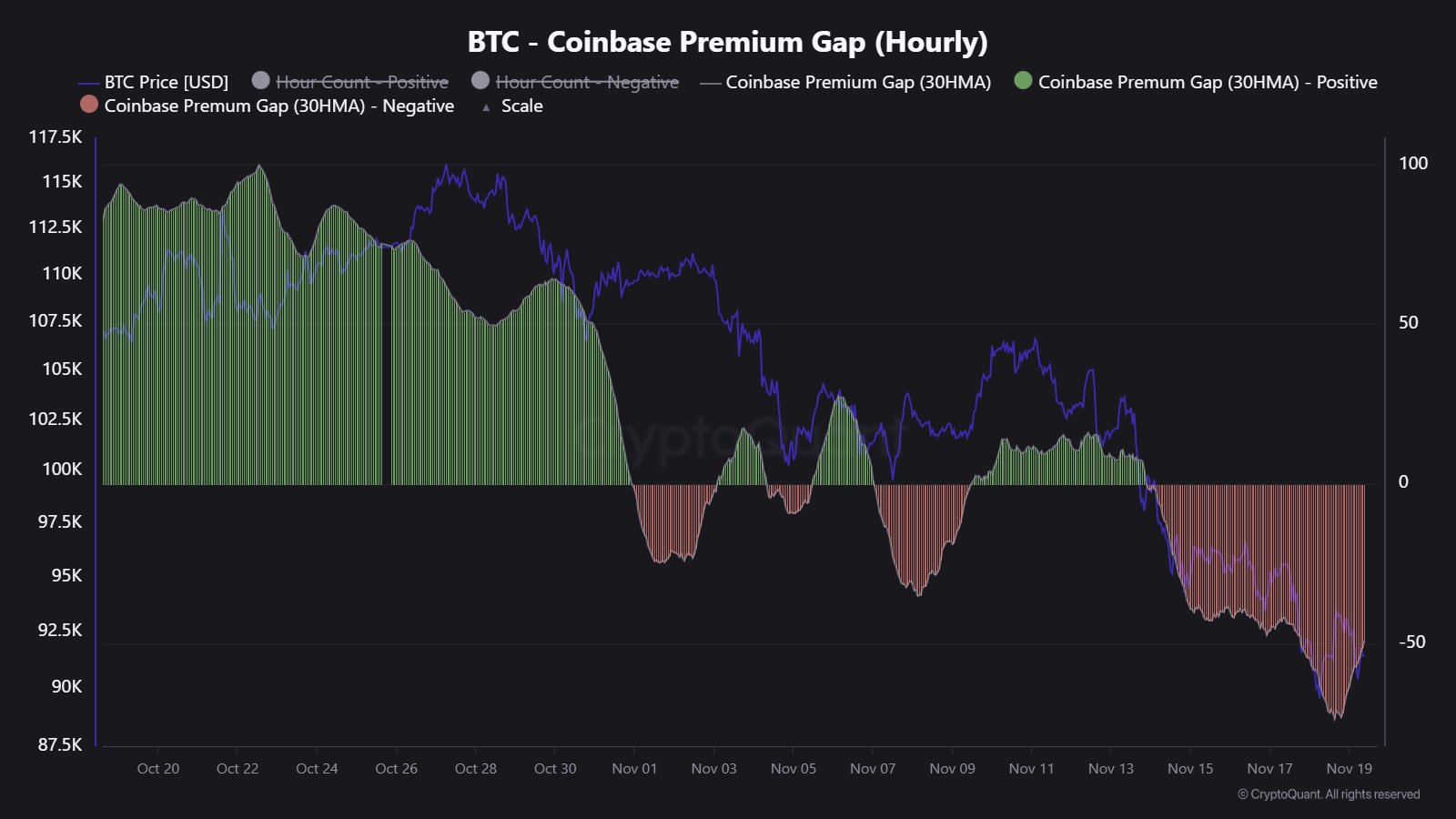

- Coinbase Premium Gap: This metric, tracking the price difference of Bitcoin between Coinbase (USD) and Binance (USDT), has plummeted into negative territory, reaching as low as -$90. This suggests strong selling pressure from US investors, particularly institutional entities.

- Cumulative Return Analysis: The American trading session has shown a deep negative return in contrast to neutral returns during European and Asia-Pacific sessions, further indicating US-led selloff pressures.

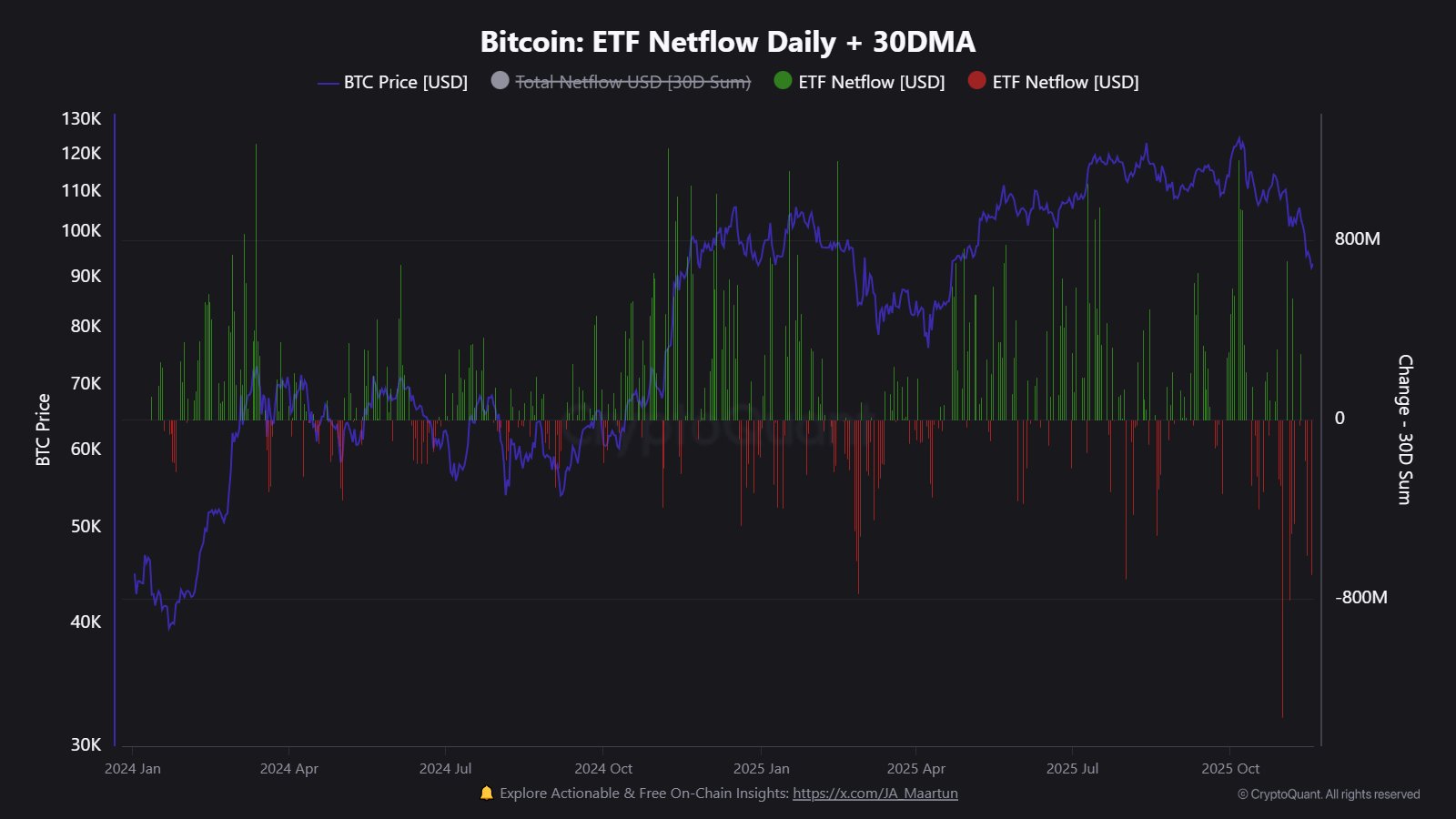

- Spot ETF Outflows: Over the past few weeks, there have been consistent outflows from spot exchange-traded funds (ETFs), deviating from previous trends where significant inflows were recorded.

The cost basis for spot ETFs is currently at $86,566. If Bitcoin falls below this level, it could lead to losses in these investments.

Current BTC Price: Bitcoin is trading around $92,000, marking a decline of over 10% in the last week.