2 0

BEARISH 📉 : U.S. Government Shutdown Threatens Crypto Market Liquidity

The U.S. crypto market structure bill is gaining attention as a potential U.S. government shutdown looms on Jan. 31.

Key Developments

- Democrats have reportedly agreed not to raise major objections during the upcoming markup sessions on Jan. 29, which may ease the bill's progression.

- Senator Roger Marshall withdrew his amendment concerning fee competition among payment networks, reducing risk of derailing the bill.

- Some unresolved amendments address crypto ATM fraud protections and restrictions on bailouts of crypto issuers.

- White House officials warned that Marshall’s amendment could jeopardize the entire bill.

Implications of a Potential Shutdown

- Republicans were prepared to support Marshall's proposal, potentially delaying legislative progress.

- The Senate Agriculture Committee is pressured to resolve issues before a possible shutdown, with a funding deadline of Jan. 30.

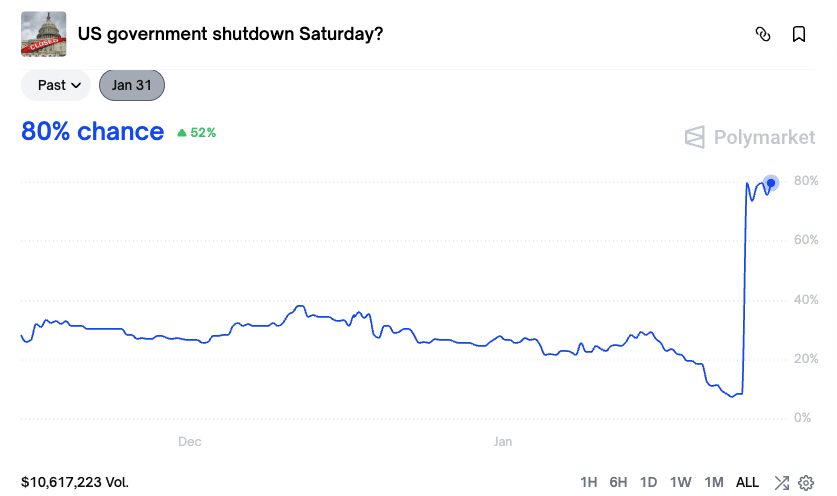

- Polymarket data indicates an 80% chance of a government shutdown by Jan. 31.

Chances of a U.S. government shutdown spike to 80%. | Source: Polymarket

Impact on Crypto Markets

- A potential shutdown could lead to liquidity withdrawals from financial markets as the Treasury rebuilds its General Account (TGA).

- Crypto assets are typically affected first by liquidity drains, historically correcting by 20-25% during similar events.

- Current thin liquidity conditions increase the risk of amplified impacts from further withdrawals.

Analyst Crypto Tice emphasized these risks, highlighting past patterns of relief rallies followed by significant pullbacks in crypto markets when liquidity tightens.