US Spot Bitcoin ETFs Surpass Satoshi Nakamoto as Largest BTC Holder

US Spot Bitcoin ETFs have significantly impacted Bitcoin and the broader crypto industry. Since their launch in January 2024, these ETFs have grown in value and holdings, setting multiple records in traditional finance.

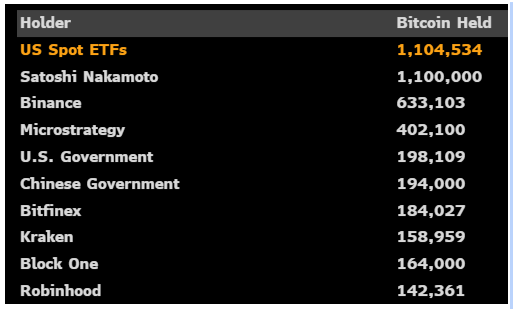

Currently, US Spot Bitcoin ETFs have surpassed Satoshi Nakamoto as the largest holder of Bitcoin.

A Historic Milestone For Bitcoin ETFs

US Spot Bitcoin ETFs have become the largest holders of Bitcoin, collectively holding 1,104,534 BTC, or approximately 5.62% of the total Bitcoin market cap. This surpasses Satoshi Nakamoto’s stash of 1,100,000 BTC, which has remained untouched for over a decade. The increase in ETF holdings is attributed to consistent inflows that have driven Bitcoin's price above the $100,000 threshold. Data from SosoValue indicates that US Spot BTC ETFs recorded seven consecutive trading days of inflows, with a notable surge of $376.59 million on December 6.

This trend is not limited to the past week; over the last 40 trading days, inflows occurred on 32 occasions. Total holdings of US Spot Bitcoin ETFs are now valued at $112.74 billion based on current Bitcoin prices.

Implications Of Growing ETF Dominance

The rise of Spot Bitcoin ETFs as the largest BTC holders reflects a maturing market and increased institutional interest. These ETFs provide a regulated way for investors to gain exposure to cryptocurrency without holding it directly, suggesting a shift towards institutional ownership of Bitcoin rather than retail investment.

The momentum behind Spot ETFs is expected to continue, driven by increasing adoption and potential approval in major markets like Europe. However, this raises concerns about market influence and centralization of crypto holdings.

On-chain data reveals that many long-term Bitcoin holders have transferred their assets into these spot ETFs to benefit from regulatory clarity.

As of now, Bitcoin is trading at $99,650, approaching a decisive break above the $100,000 level.

Featured image from Blue Trust, chart from TradingView