BEARISH 📉 : US Treasury Confirms No Bitcoin Bailout Amid Regulatory Concerns

Key Points:

- The U.S. Treasury has confirmed it cannot bail out Bitcoin, highlighting the absence of a government safety net for cryptocurrencies.

- The focus in the crypto market is shifting from passive holding to active infrastructure developments that provide utility.

- Bitcoin Hyper integrates the Solana Virtual Machine (SVM) to enhance Bitcoin with high-speed smart contracts, addressing its scalability issues.

- The presale for Bitcoin Hyper has raised over $31.2 million, indicating strong interest and accumulation by large investors.

The US Treasury's position emphasizes that the crypto industry must rely on its own infrastructure without expecting external financial support during crises.

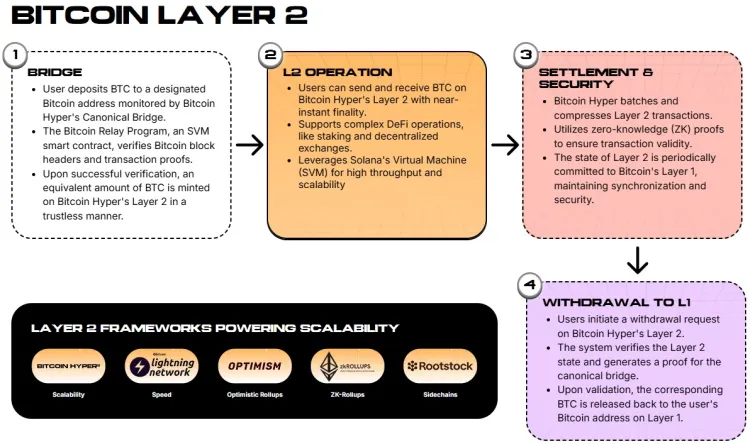

Bitcoin Hyper aims to transform Bitcoin into a programmable ecosystem, using SVM as a Layer 2 solution to improve execution speed and support complex decentralized applications (dApps).

The architecture uses a decentralized canonical bridge for seamless Bitcoin transfers, with a modular design where L1 handles settlement and SVM L2 manages execution. This development allows developers to build using Rust with SDK support, tapping into Bitcoin's liquidity for DeFi activities.

Smart money is actively investing in Bitcoin Hyper, as evidenced by significant presale participation and whale accumulation, positioning for potential growth in Bitcoin's infrastructure capabilities.