14 0

VanEck Predicts Bitcoin May Reach $180,000 Amid Bull Market

VanEck’s Mid-October 2025 analysis suggests that Bitcoin could reach up to $180,000 if certain economic factors align. The firm associates Bitcoin's growth with global money supply and futures market dynamics.

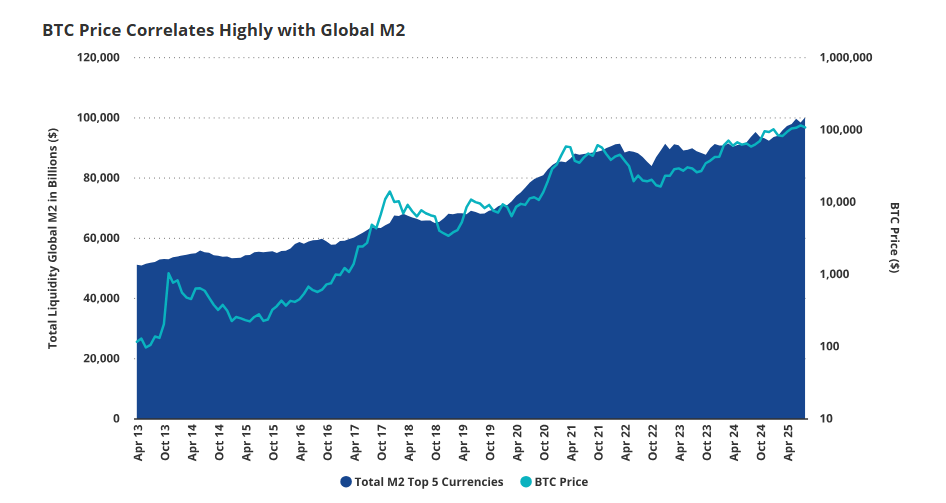

Correlation with Global Money Supply

- Bitcoin shows a 0.5 correlation with global M2 growth since 2014.

- Global liquidity in major currencies increased from $50 trillion to nearly $100 trillion over the same period.

- Bitcoin’s price grew approximately 700x during this time.

- VanEck considers Bitcoin’s current size at about 2% of the global money supply.

Futures Market Influence

- 73% of Bitcoin’s price variance since October 2020 is linked to futures open interest.

- Cash collateral for futures contracts is around $145 billion.

- Open interest peaked at $52B but fell to $39 billion after a significant BTC price drop.

- Borrowed positions often rapidly unwind, contributing to price volatility.

Market Dynamics and Projections

- A soft US CPI or eased trade tensions may boost Bitcoin to $130,000–$132,000 by Q1 2026.

- Short-term targets include $129,200 and $141,000.

- Price action ranges between $108,000 and $125,000, with a critical support near $108,600.

Overall, holding above $108,000 supports an upward trend, while shifts in macroeconomic conditions could redirect capital flows into Bitcoin.