5 0

Vanguard’s Bitcoin ETF Pivot Boosts Interest in Layer 2 Solutions

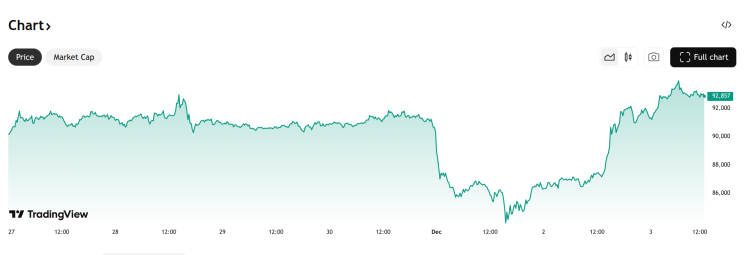

- Vanguard's entry into the spot Bitcoin ETF market marks a significant shift, channeling retirement and retail capital into Bitcoin.

- This inclusion by major asset managers like BlackRock and Fidelity positions Bitcoin as a macro asset similar to digital gold.

- Traders are moving towards higher-risk investments such as ecosystem plays and infrastructure tokens due to Bitcoin's stabilization as an 'ETF-wrapped' asset.

- The race is intensifying among Bitcoin Layer 2 projects aiming to enhance DeFi, gaming, and payment flows on the Bitcoin network.

- Bitcoin Hyper ($HYPER) aims to address Bitcoin's speed, fees, and programmability limitations by integrating Solana Virtual Machine (SVM) on a modular Layer 2.

- Infrastructure projects are competing to add smart contracts and high throughput capabilities to Bitcoin without affecting its settlement assurance.

- Bitcoin Hyper differentiates itself with SVM compatibility, targeting traders and DeFi users seeking amplified Bitcoin exposure.

- The Bitcoin Hyper presale has raised over $28.8M, indicating interest from high-net-worth investors.

- The potential ROI for Bitcoin Hyper is projected at over 545%, based on anticipated future price increases.

Vanguard's participation in Bitcoin ETFs not only increases Bitcoin's market cap but also changes traditional investment perceptions, encouraging exploration of Layer 2 solutions for enhanced functionality.