2 0

WazirX Outlines Recovery Plan Following $235 Million Cyberattack

WazirX, an Indian crypto exchange, is implementing a recovery plan following a $235 million hack in July 2024. The restructuring is supervised by Singapore's legal system and involves a moratorium filed by its parent company, Zettai, at the Singapore High Court.

- The restructuring plan includes a Scheme of Arrangement to manage debts and prevent liquidation.

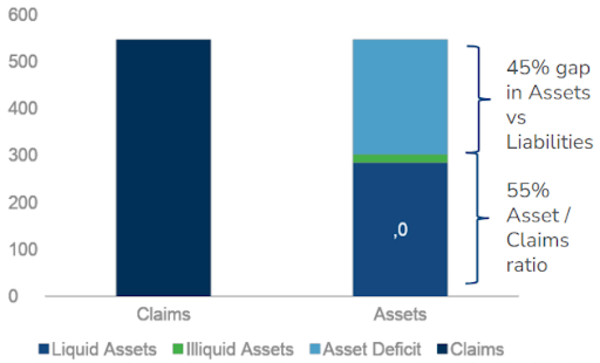

- WazirX currently holds $566.4 million USDT in liquid assets against $546.5 million USDT in user claims.

- Recovery tokens will be issued, allowing creditors to benefit from future profits.

- Initial distributions to users are expected to cover 75% to 80% of their account balances post-approval of the scheme.

Nichal Shetty, WazirX's founder, emphasized that this process aims to restore trust with users rapidly. He stated that token distributions will occur shortly after creditor approval.

CoinSwitch, a competitor, is launching a recovery fund of 600 crore Indian rupees ($69.9 million) to assist WazirX victims and is pursuing legal action for funds stuck on WazirX.

Source: WazirX