3 0

Anti-CZ Whale Flips Bullish: Now Long $109M In Ethereum

The crypto market experienced a sharp downturn, with Ethereum falling below $3,100 and Bitcoin dropping significantly, leading to widespread liquidation and panic selling. This has flipped market sentiment to bearish with traders reducing exposure.

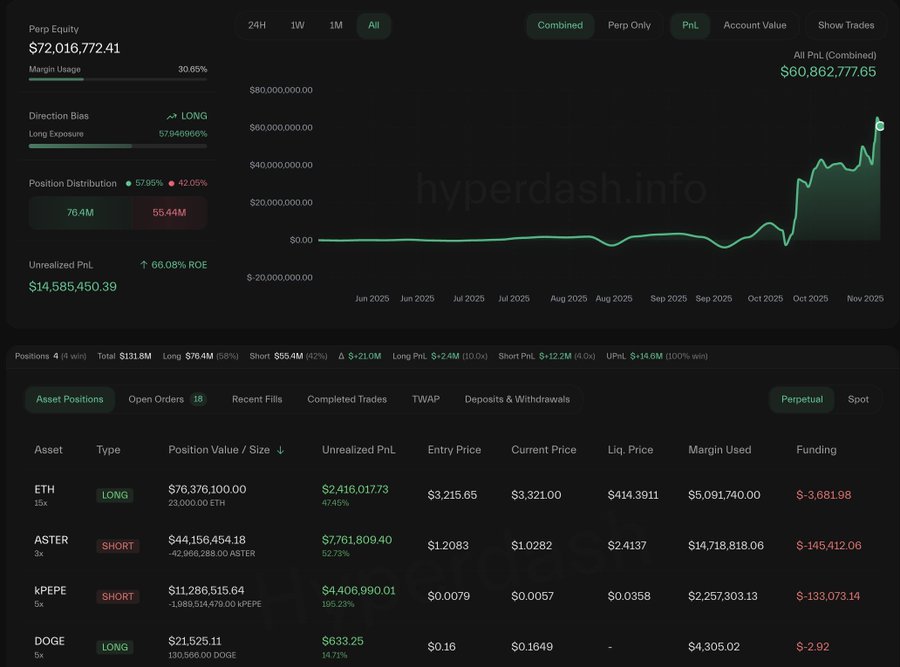

- The Anti-CZ Whale, known for strategic trades, shifted from shorting Ethereum to taking a long position of 32,802 ETH (~$109 million), indicating confidence in Ethereum despite the downturn.

- The whale maintains a significant short on ASTER valued at approximately $59.7 million, suggesting an expectation of continued weakness in ASTER.

- A small position in DOGE is likely more symbolic, serving as a hedge or sentiment gauge.

Ethereum's price is attempting to stabilize around $3,300, near its 200-day moving average, which is a critical support level. Heavy volatility and sell-side volume confirm panic-driven liquidations rather than a fundamental trend shift.

- The recent decline followed a series of lower highs, indicating weakening momentum.

- Key resistance levels include the 50-day and 100-day moving averages currently trending downward.

- Volume spikes suggest capitulation behavior, often a sign of approaching cycle pivots.

- If ETH holds above the 200-day MA, a relief rally could follow, but a break below $3,150 may lead to further declines toward $2,900 due to thin liquidity.