6 0

Whale Invests Millions in Tokenized Gold, Bitcoin Sees Decline

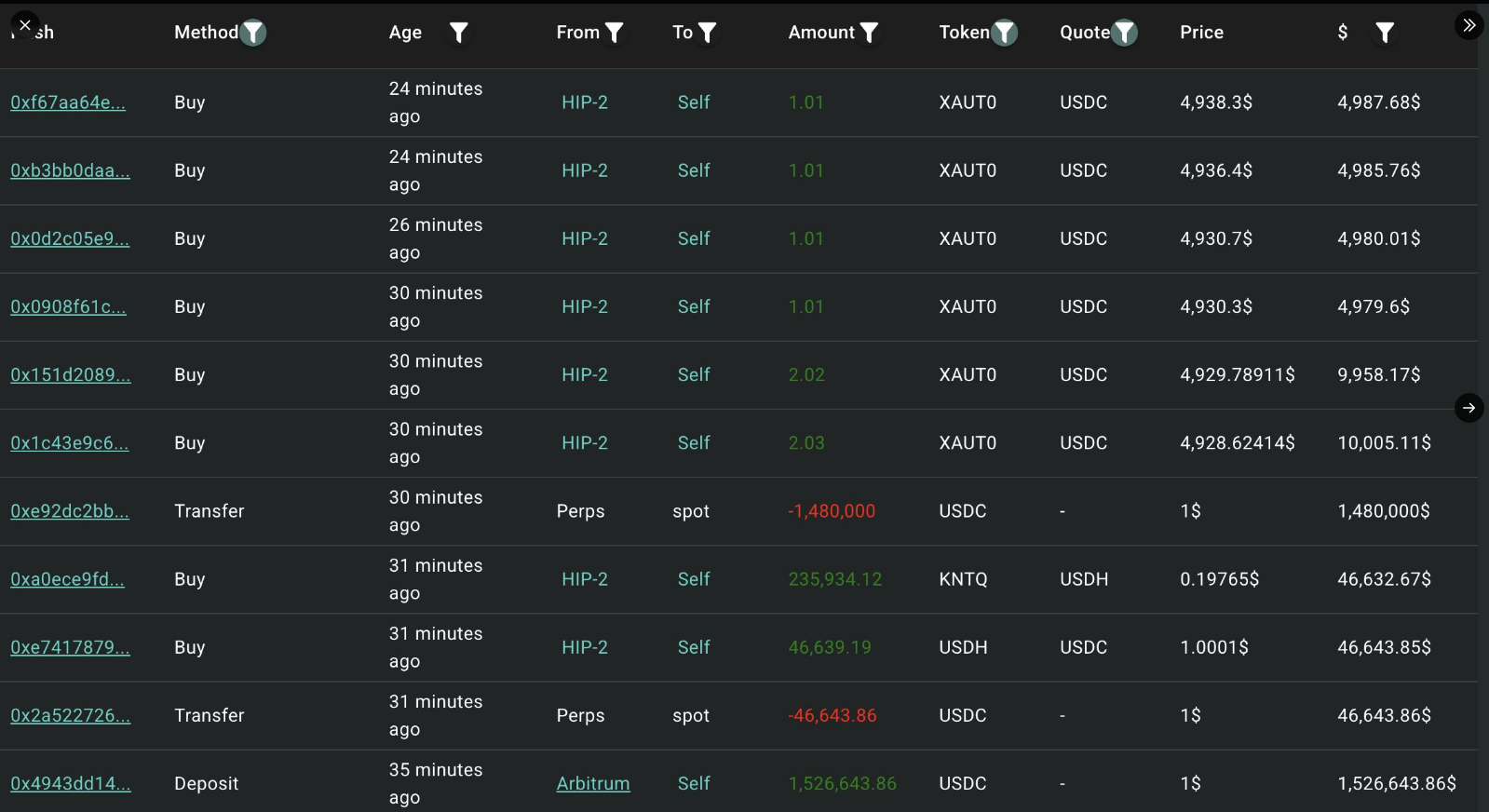

A significant investor has shifted funds into tokenized gold, impacting Bitcoin prices, which dipped as a whale quietly purchased millions in XAUT, a gold-backed token, indicating a short-term move towards traditional hedges.

Key Highlights

- On-chain trackers revealed a transfer of $1.53 million in USDC into Hyperliquid to purchase XAUT. The same wallet previously acquired 481 XAUT valued at approximately $2.38 million.

- The address retains around $1.44 million in USDC, suggesting potential future purchases.

- This activity demonstrates a preference among some large holders for gold exposure over additional crypto risk.

Gold and Silver Market Movements

- Gold prices have surged, reaching close to $5,000 per ounce, while silver surpassed $100 per ounce.

- The rise is linked to geopolitical tensions and anticipated interest rate easing, boosting demand for metal-based value stores.

- A weaker dollar has contributed to this demand surge.

Bitcoin’s Price Movement and Market Sentiment

- Bitcoin traded around $88,653, down about 1% on the day and nearly 30% below its previous cycle peak.

- Economist Peter Schiff criticized Bitcoin's underperformance against gold since 2021, suggesting an opportunity cost for BTC holders as metals reach record prices.

Implications for Crypto Investors

- Short-term rotations indicate shifting risk preferences amid uncertain policy environments and heightened headlines.

- While some investors favor lower-volatility assets, others continue to view Bitcoin as a long-term investment.

- The current market landscape features strong metals, growing attention towards tokenized gold, and reactive crypto markets.