10 2

Crypto Whale Moves $129M to Binance Amid Key Macro Events

- On Oct. 15, a $129 million transfer from the "Hyperunit" trading entity to Binance was detected.

- Hyperunit, managing over $10 billion in crypto assets, previously profited from shorting Bitcoin after Trump announced tariffs on Oct. 10.

- The move led to $19 billion in crypto futures contracts being liquidated, reducing the sector's market cap by 9%.

- Speculation suggests this transfer may be linked to upcoming macro events like the US Fed rate decision on Oct. 29 and the ongoing US Government Shutdown.

- At press time, Bitcoin's price was around $111,400, fluctuating between $110,235 and $113,622.38.

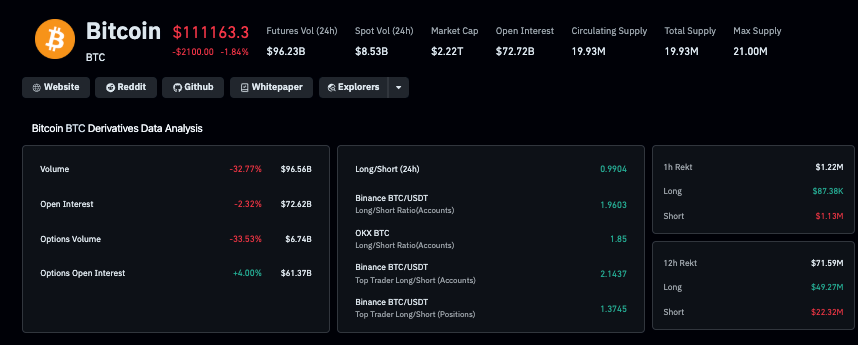

- Bitcoin's open interest fell to $72 billion as traders anticipate macroeconomic volatility.

- Bitcoin traded at $111,169, down 1.62%, lagging behind the S&P 500 for three sessions.

- The Hyperunit wallet's activity might cause traders to reduce leverage, given its previous accurate predictions.

- Coinglass data shows a 32.77% drop in Bitcoin futures volume, with a bearish long-to-short ratio of 0.99.

- The Best Wallet presale surpassed $16.5 million, targeting the $26 billion custodial wallet market with multi-chain support and high-security features.

Token trades at $0.026 are ongoing through the official Best Wallet website.