Whales Accumulate Record 670,000 Bitcoin Holdings Amid Price Speculation

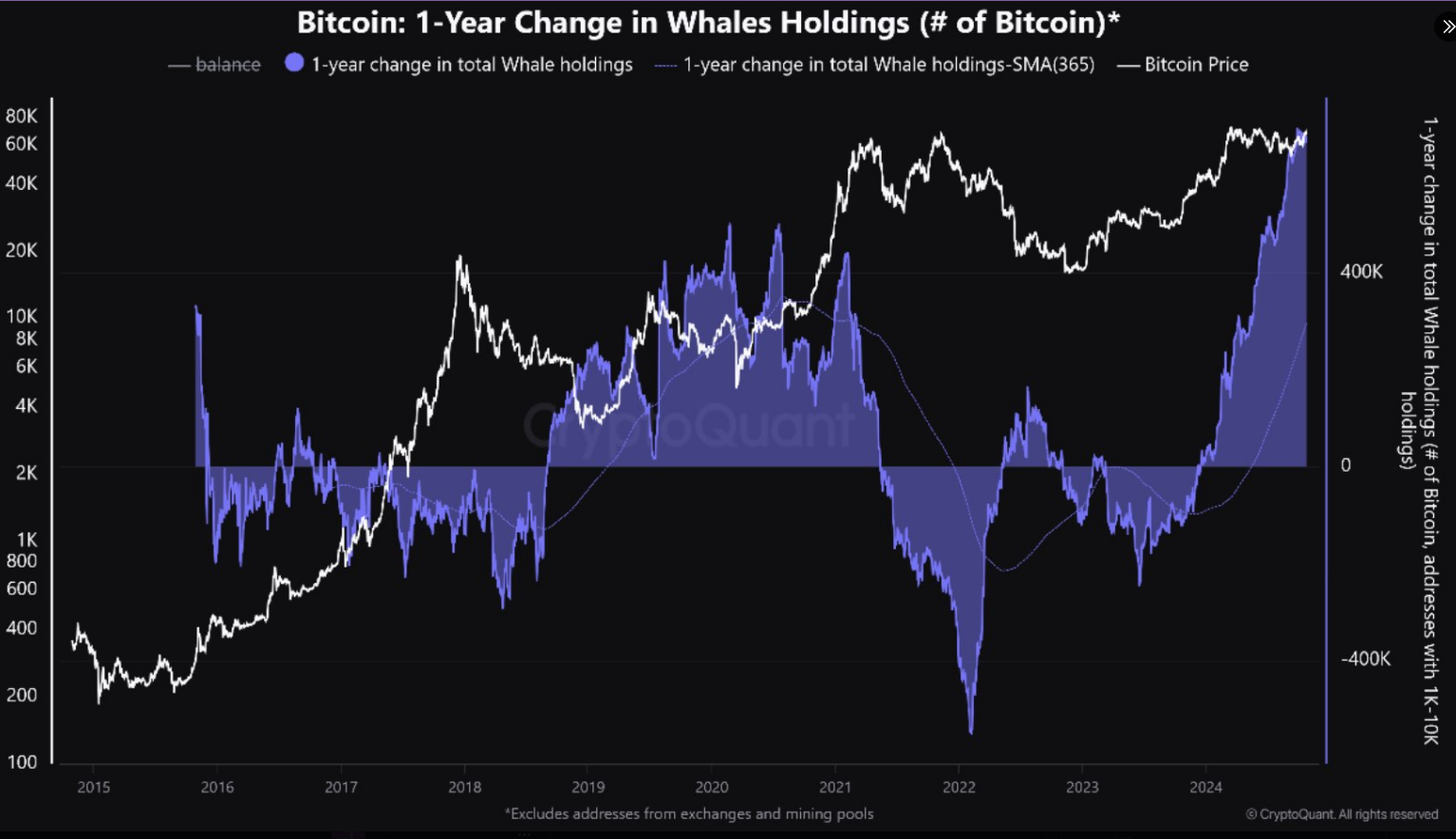

Analysts report that Bitcoin prices may experience a slight decline in the short term due to record-high whale accumulation, with holdings reaching 670,000 BTC.

Impact Of Whale Accumulation

Whale purchases of large Bitcoin volumes can stabilize the market. This reduction in available Bitcoin may decrease price volatility. Historical trends indicate that during previous whale accumulations, BTC often either remains flat or slightly declines. The current phase may suggest that whales intend to hold their assets long-term, viewing accumulation as a strategic move.

Real Indicator Of Bitcoin Growth

According to CryptoQuant, the whale accumulation signals a potential 'calm before the storm,' where Bitcoin typically moves sideways or sees moderate declines during this phase. However, it is regarded as an optimistic sign for long-term growth.

Whales’ holdings are at an all-time high

“Whales currently hold around 670,000 $BTC, which is the highest value ever. Undoubtedly, this is an optimistic long-term sign.” – By @BaroVirtual

Full post

https://t.co/MoFLpZ3Rmh pic.twitter.com/7esCP6fVBE

— CryptoQuant.com (@cryptoquant_com) October 24, 2024

Analysts noted that significant growth in Bitcoin often follows a period when whales reduce their holdings and reach a negative percentage change. Historical patterns show that price movements during accumulation phases typically precede substantial increases in BTC value.

Whales hold record 670K BTC, analysts expect possible surge

According to CryptoQuant analyst BaroVirtual, whales currently hold approximately 670,000 Bitcoin (BTC)—the highest level on record. Analysts suggest this accumulation phase, marked by Bitcoin’s sideways trend or…

— CoinNess Global (@CoinnessGL) October 24, 2024

US Elections Could Be A Factor

While whale activity significantly influences the crypto market, other factors also affect Bitcoin prices, including the US presidential election. Analysts anticipate this election could impact the digital currency market, as candidates' platforms include crypto-friendly policies.

Some investors predict that regardless of the election outcome, Bitcoin prices may rise, potentially reaching $80,000 by November.

Featured image from Harbor Breeze Cruises, chart from TradingView